XRP, one of the leading cryptocurrencies by market capitalization, has faced a dramatic downturn, shedding over $7 billion in value within a single 24-hour period.

XRP, one of the leading cryptocurrencies by market capitalization, has faced a dramatic downturn, shedding over $7 billion in value within a single 24-hour period. This sharp decline highlights a potential moment of reckoning in the ongoing bull market and raises critical questions about market sentiment and short-term momentum.

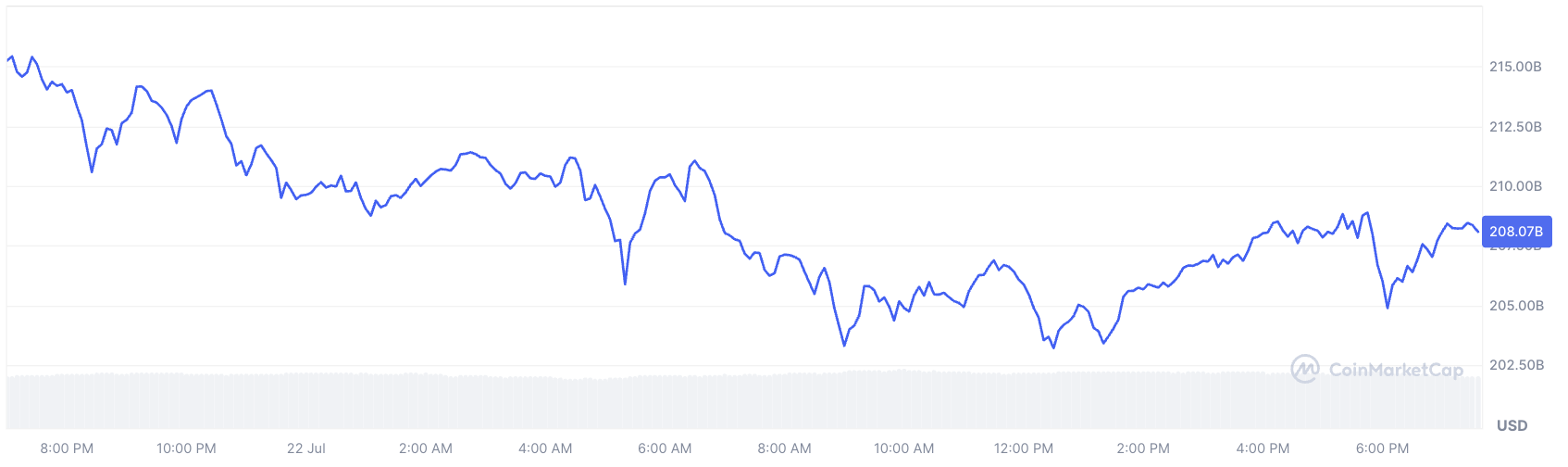

In recent trading, XRP’s overall market cap dropped from approximately $215 billion down to nearly $208 billion. This represents its most significant one-day loss in several weeks. This pullback appears to be part of a broader cooling trend across the digital asset space, as the total global crypto market cap declined by 1.1%. More than $556 million was liquidated across exchanges during this window, emphasizing the widespread effect of the market correction.

Notably, even Bitcoin wasn’t immune to the downturn. The flagship cryptocurrency experienced its first substantial exchange-traded fund outflow since early June, underlining the scale of current investor hesitation and the growing atmosphere of caution.

The correction comes after a remarkable two-week period in which XRP rallied more than 50%, bringing it to a high of $3.51 before tumbling to $3.42 in a swift intraday drop—the steepest hourly decline seen throughout the day. This type of rapid reversal is not uncommon, especially for an asset like XRP that holds a market cap in the hundreds of billions and typically sees heightened profit-taking after such aggressive rallies.

Analysts suggest that this market behavior may be linked to a broader phenomenon often seen post-hype or following major regulatory or event cycles. Recently, activity surrounding XRP had intensified due to developments like the highly anticipated golden cross formation and ongoing optimism around Ripple’s positioning within institutional finance. However, as the immediate excitement fades, the market is subject to short-term volatility and sell-offs from traders eager to lock in profits.

Additionally, signals from broader market dynamics cannot be ignored. A return of high open interest in altcoins—equalling or surpassing that of Bitcoin—serves as a historical red flag. When alternative assets begin to see disproportionate exposure, the likelihood of a widespread correction increases due to excessive leverage and speculative enthusiasm.

XRP’s earlier rally had many speculating about further highs, especially with the recent formation of a major golden cross suggesting bullish momentum. Yet, the current behavior acts as a resetting phase, a familiar step in any extended bullish trend, rather than a definitive end to positive momentum.

Market watchers are keeping an eye on macroeconomic developments for determining whether this is merely a pause or the beginning of a deeper correction. The lack of clear forward guidance and the tapering off of market excitement post-events make the current environment particularly prone to such exit moves.

At this point, XRP is attempting to stabilize. Recovering from major price retracements requires sustained buying support, improved sentiment, and possibly momentum-building news from Ripple’s broader ecosystem. Until then, investors may continue navigating choppy waters as bullish confidence resets across the crypto landscape.

Related: XRP Price: $12M Max Pain for Bears

While some traders are interpreting this drop as a sign of fading momentum, others argue it may only be a breather within an overheated rally. Either way, the XRP community and broader crypto market participants are faced with a period of watchful waiting as the market recalibrates following a rapid and intense surge.

Quick Summary

XRP, one of the leading cryptocurrencies by market capitalization, has faced a dramatic downturn, shedding over $7 billion in value within a single 24-hour period. This sharp decline highlights a potential moment of reckoning in the ongoing bull market and raises critical questions about market sentiment and short-term momentum.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.