XRP settlement technologies are rapidly transforming the financial landscape by delivering round-the-clock liquidity that reshapes traditional banking models.

XRP settlement technologies are rapidly transforming the financial landscape by delivering round-the-clock liquidity that reshapes traditional banking models. While emails travel across continents in seconds, financial transactions often lag behind — particularly international payments, which can take days or even longer during weekends or holidays. This delay doesn’t just inconvenience users; it immobilizes trillions of dollars, preventing them from earning meaningful returns.

Why Instant Liquidity Matters

For corporations and financial institutions alike, slow access to funds translates into greater operational costs and inefficiencies in managing capital. Businesses are stuck with dormant assets that could otherwise be fueling new opportunities. In a digitally driven world where real-time transactions are becoming the norm, the lack of instant financial settlement becomes a major drag on economic agility.

Stablecoins Spark the Transition

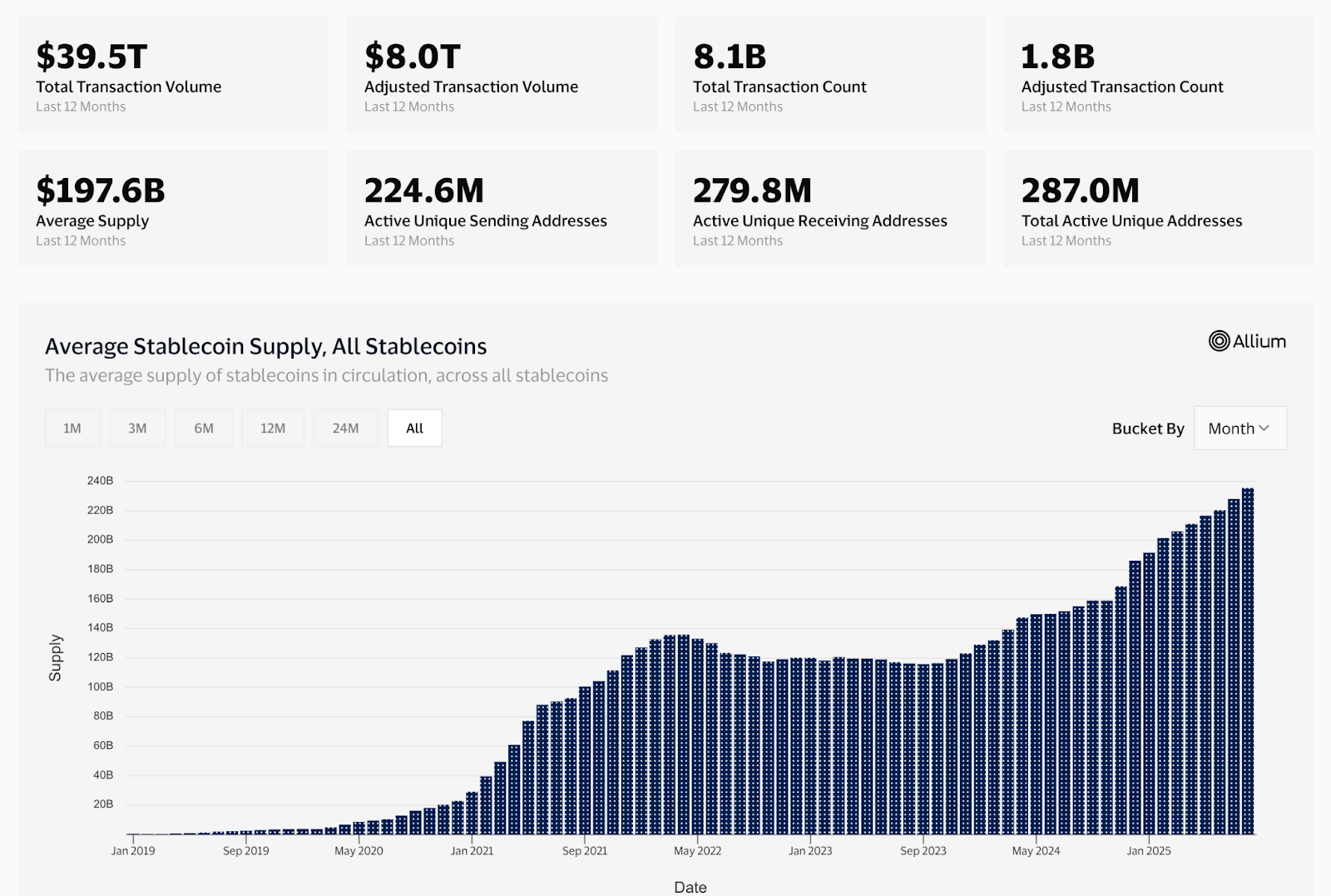

Stablecoins have proven critical in evolving towards faster finance. By enabling instantaneous transactions over blockchain networks, trillions of dollars now settle faster than ever. They bring an internet-speed solution to money movement, making them integral to crypto transactions, remittances, and payment workflows.

Chart outlining the average supply of all stablecoins in global circulation.

Despite their speed, stablecoins offer little in terms of yield. Hundreds of billions of dollars held in stablecoin balances earn effectively nothing. Compared to tokenized treasuries and digital money market instruments, which generate interest at low risk, stablecoins fall short in capital productivity. But even with tokenized yield-bearing assets, long subscription and redemption cycles — often on T+2 timelines — still trap capital in inefficient processes.

Tokenization and Future Integration

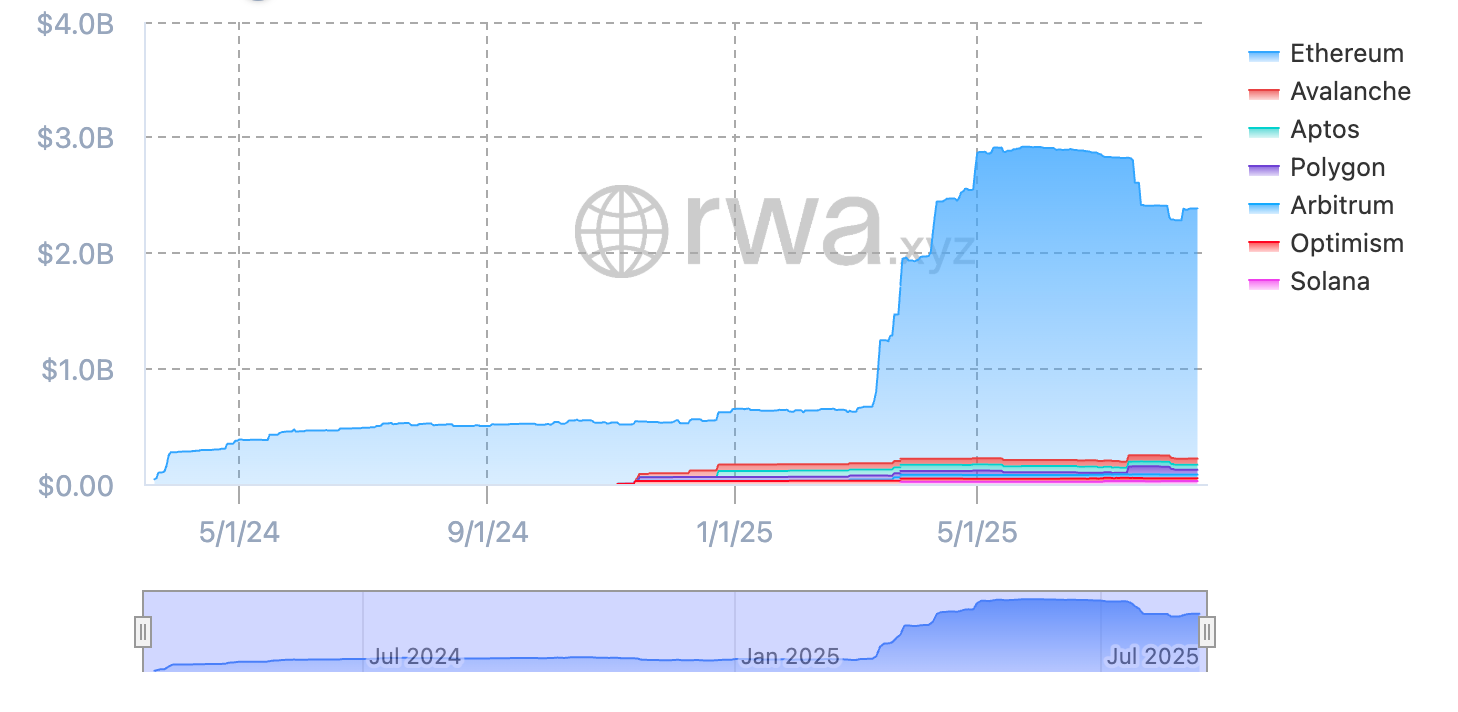

The fintech ecosystem is approaching a breaking point of innovation convergence. Established asset managers now issue tokenized funds, with BlackRock’s BUIDL fund alone managing over $2 billion in tokenized assets.

Tracking the growth of real-world tokenized assets including BlackRock’s BUIDL fund.

These digital funds can be transferred instantly and even settle atomically when paired with stablecoins. As volumes rise, demand for effective treasury and cash management also intensifies, making tokenized treasuries the ideal complementary vehicle.

However, current market friction originates from missing infrastructure. Secure, standardized frameworks for atomic, real-time swaps between stablecoins and tokenized securities don’t yet exist. Without them, we’re merely replicating outdated systems in a digital context. What’s needed is seamless, neutral connectivity that supports 24/7 liquidity and eliminates slippage, delays, and third-party dependencies.

Unlocking Trillions Through XRP and Tokenization

The implications are significant. Nearly $4 trillion in non-interest-bearing U.S. bank deposits could be redirected into tokenized treasuries and seamlessly converted into stablecoins when necessary. This transformation would not merely enhance efficiency — it could unlock hundreds of billions of dollars in passive income for businesses and individuals alike, all while maintaining full liquidity.

Such an evolution demands open, interoperable infrastructure. While some providers may benefit from closed ecosystems, real market transformation only happens when transparency and shared incentives bring together all stakeholders — including issuers, custodians, asset managers, and investors. Just like global payment systems needed standardized protocols, so do tokenized marketplaces that want to deliver consistent liquidity.

Building the Future of Continuous Settlement

This liquid-funds revolution isn’t a technological fantasy. Many of the essential components already exist — including smart contracts, XRP’s native capabilities, programmable money, and tokenized risk-free assets. What’s urgent now is collaborative action from technologists, regulators, and financial institutions to implement these tools cohesively.

Related: XRP Price: $12M Max Pain for Bears

The real goal isn’t just faster payments — it’s a completely redefined financial architecture where money is never idle, yield stays accessible, and liquidity has no closing hours. With XRP settlement acting as a key enabler, institutions can step into a future where finance never sleeps. Those who adapt will lead tomorrow’s markets; those who delay may be phased out altogether.

Quick Summary

XRP settlement technologies are rapidly transforming the financial landscape by delivering round-the-clock liquidity that reshapes traditional banking models. While emails travel across continents in seconds, financial transactions often lag behind — particularly international payments, which can take days or even longer during weekends or holidays.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.