Bitcoin indicators are signaling a potential move into bearish territory as investors closely watch the Federal Reserve’s upcoming remarks at the Jackson Hole Symposium. The shift in sentiment is becoming evident across multiple technical indicators and options market indicates.

Bitcoin indicators are signaling a potential move into bearish territory as investors closely watch the Federal Reserve’s upcoming remarks at the Jackson Hole Symposium. The shift in sentiment is becoming evident across multiple technical indicators and options market signals.

Options Market Shows Increased Demand for Puts

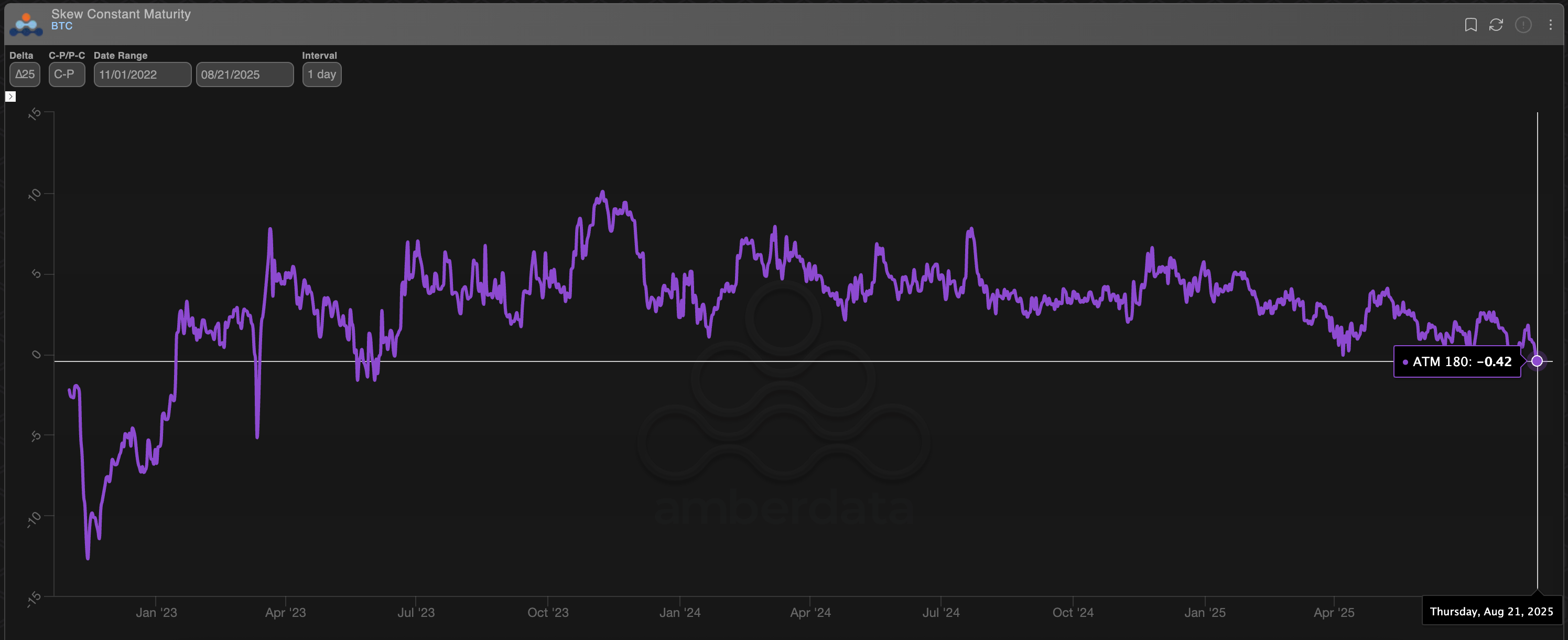

One of the most telling signs of this bearish transition comes from the 180-day call-put skew on Deribit, the top crypto options platform by volume and open interest. Currently, this metric has dropped to -0.42, marking its lowest value since June 2023 — a level that suggests traders are increasingly hedging against potential declines.

This negative skew points to a growing preference for put options over calls, reflecting broader uncertainty and concern among market participants. According to Imran Lakha, founder of Options Insights, a negative premium in longer-term options could indicate a significant change in sentiment. Lakha highlighted this shift on X, pointing out that traders are repositioning ahead of Jerome Powell’s Jackson Hole speech.

BTC’s 180-day options skew flips negative, signaling increased bearish sentiment. (Deribit/Amberdata)

Despite a modest 8% retreat from its recent all-time high above $124,000, the overall tone in the market has shifted significantly. Traders are seen buying put options with strike prices around $110,000 for August and September, reducing exposure to call positions as they prepare for Powell’s address.

Lakha notes that Bitcoin won’t likely show a bullish skew until March 2026. In the meantime, traders remain cautious, adjusting their strategies amid uncertainty around interest rate policies.

Rate Expectations and Market Reactions

Fed Chair Jerome Powell is expected to address interest rate forecasts during his speech at the Jackson Hole Symposium, drawing heightened attention from crypto and equity investors alike. According to Investopedia, the central bank’s signaling could determine whether risk assets like Bitcoin experience further correction or recovery.

Nicolai Sondergaard, a research analyst at Nansen, believes that current rate cut expectations are already largely priced in by the market. “If Powell states what traders already anticipate, we could see a modest downturn or sideways movement — the typical ‘sell the news’ scenario,” said Sondergaard. However, a faster-than-expected cutting cycle may revive risk appetite and renew upward momentum.

Equity Markets Mirror Crypto Sentiment

The downturn in sentiment among Bitcoin traders echoes similar moves in the broader financial markets. On Wall Street, investors are snapping up protective “disaster puts” on major tech ETFs like the Invesco QQQ Trust Series 1, which follows the Nasdaq 100 Index. Jeff Jacobson of 22V Research Group told Bloomberg that this activity highlights concerns over a potential tech-stock pullback. (source)

Technical Breakdown via Guppy Moving Averages

Another bearish omen comes from the Guppy Multiple Moving Average (GMMA) indicator — a tool developed by analyst Daryl Guppy to measure trend direction. This indicator analyzes short-term and long-term moving average clusters to detect potential reversals.

Bitcoin has now slipped below its GMMA bands, ending a stretch of upward dominance. This pattern suggests that bullish momentum is fading, confirming a broader regime shift in market sentiment.

Bitcoin’s price drops below Guppy averages, indicating weakening trend strength. (TradingView)

Other indicators, such as the MACD histogram, also suggest further downside risk in the near term, reinforcing the bearish outlook.

Related: Cardano Bull Setup Points to December Rally

For more on current crypto trends: Bitcoin Holds at $113K; Solana and Dogecoin Lead Gains

Quick Summary

Bitcoin indicators are signaling a potential move into bearish territory as investors closely watch the Federal Reserve’s upcoming remarks at the Jackson Hole Symposium. The shift in sentiment is becoming evident across multiple technical indicators and options market signals.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.