XRP price predictions are heating up as industry attention turns to the upcoming deadlines for spot XRP Exchange-Traded Funds (ETFs) in October. If the U.S. SEC approves these ETFs, analysts expect a significant market shift before the end of 2025.

XRP price predictions are heating up as industry attention turns to the upcoming deadlines for spot XRP Exchange-Traded Funds (ETFs) in October. If the U.S. SEC approves these ETFs, analysts expect a significant market shift before the end of 2025.

Spot XRP ETFs Awaiting Approval This October

According to a recent Bloomberg report, more than a dozen XRP-related ETF filings are under review for 2025, including seven that are spot ETFs. These

spot ETF applications are scheduled for SEC decision in October, a month that could redefine XRP’s market status. Meanwhile, leveraged products like Teucrium’s XXRP ETF have already gained regulatory approval and entered the market.

Institutional Interest Signaling Growing Confidence

Teucrium’s leveraged XRP ETF has delivered astonishing results. In just three months, it became the most successful product in the asset manager’s 16-year history, surpassing $300 million in capital inflows. The success of this product has reinforced investor confidence in spot ETF viability.

At the same time, XRP futures contracts on the Chicago Mercantile Exchange (CME) have rapidly surged in popularity. XRP now holds the record for reaching $1 billion in open interest faster than either Bitcoin or Ethereum. This rapid growth signals deep institutional demand for regulated XRP exposure.

Steven McClurg, CEO of Canary Capital and among those preparing to launch a spot XRP ETF, expressed strong expectations for early performance. According to

McClurg, XRP spot ETFs could attract up to $5 billion in inflows during their first month alone, potentially eclipsing Ethereum ETF performance.

Currently, XRP is valued at $2.71, with a market capitalization of $163.1 billion. Yet, its future valuation could shift dramatically depending on the ETF approval outcome.

Potential XRP Price in a Bullish ETF Scenario

To better understand the long-term potential, Google Gemini AI was asked to model a bullish scenario where all spot XRP ETFs gain approval by October. In this scenario, Gemini explained that regulated ETF channels could give institutions like pension funds and hedge funds easier access to XRP. This institutional demand would introduce strong buying pressure as fund issuers purchase XRP to back their products.

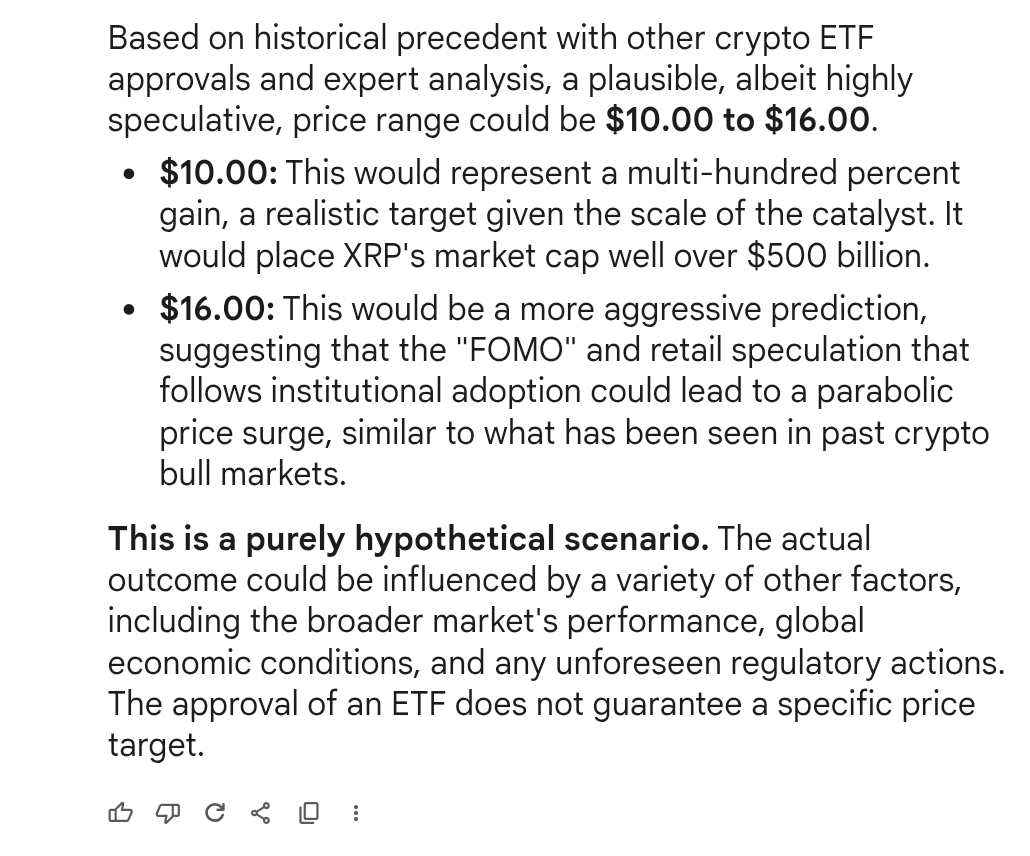

Google Gemini’s projected XRP price range based on spot ETF approval by October 2025.

Additionally, Gemini noted that media attention surrounding ETF approvals could trigger a “fear of missing out” effect among retail investors. This surge in mainstream interest could amplify demand and contribute to a price spike.

With these dynamics in play, Gemini projected a possible XRP price range of $10 to $16 by December 2025. At the lower end, this would move XRP’s market cap beyond $500 billion. At the higher end, XRP could mirror explosive rallies seen during previous crypto bull markets.

This projection remains speculative and depends on several external factors, including global economic stability, regulatory developments, and overall sentiment in the crypto space.

For context, a $10 XRP price requires nearly a fourfold increase from its current level, driven by large-scale institutional inflows. While optimistic, such a move is plausible in a market fueled by ETF announcements and favorable regulatory outcomes.

That said, Gemini emphasized the need for caution even in bullish scenarios, reminding investors that macroeconomic conditions and unforeseen events could shift the outcome.

Related: XRP Price: $12M Max Pain for Bears

Conclusion: High Hopes Rest on SEC Decision

The outlook for XRP price is highly dependent on the SEC’s decision regarding spot ETFs this October. If approved, these products could channel billions into XRP markets, attract institutional interest, and possibly fuel a year-end rally. However, market participants should remain aware of potential volatility and underlying market risks.

Quick Summary

XRP price predictions are heating up as industry attention turns to the upcoming deadlines for spot XRP Exchange-Traded Funds (ETFs) in October. If the U.S. SEC approves these ETFs, analysts expect a significant market shift before the end of 2025.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.