Crypto markets experienced volatility following cautious remarks from the Federal Reserve regarding future interest rate cuts. Bitcoin is trading below its all-time high, with analysts pointing to muted enthusiasm and significant options expiry as contributing factors.

What to Know:

- Crypto markets experienced volatility following cautious remarks from the Federal Reserve regarding future interest rate cuts.

- Bitcoin is trading below its all-time high, with analysts pointing to muted enthusiasm and significant options expiry as contributing factors.

- Despite market turbulence, underlying strength is indicated by stable open interest in Bitcoin futures and a resilient options market.

The crypto market is navigating a period of uncertainty following recent signals from the Federal Reserve, impacting assets like Bitcoin and XRP. Despite an initial rate cut, hints at potential pauses in further easing have triggered market adjustments. Investors are closely watching Bitcoin’s price movements and derivative positioning amid these macroeconomic developments.

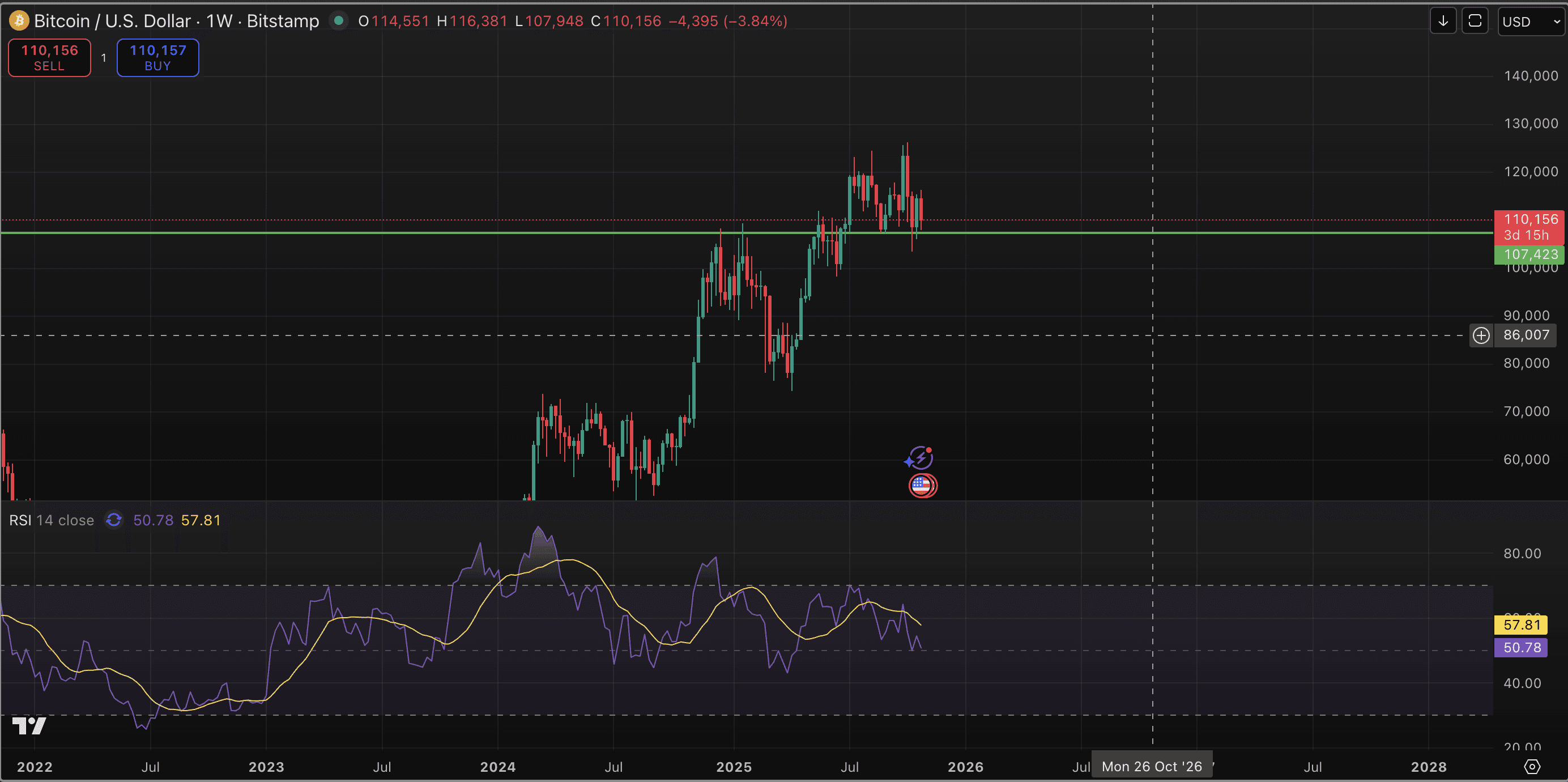

Market makers are exposed to negative gamma around the $100,000 to $111,000 strike prices, suggesting potential for amplified price swings as the week concludes. Traders should be prepared for increased volatility as hedging activities influence market dynamics. The options market maintains a bullish lean, though short-term conviction has moderated slightly.

Bitcoin is currently holding above its critical weekly support level at $107,000, having successfully bounced off this zone earlier on Thursday. Maintaining this support is key. Should this core support area break, the next significant level to watch would be a potential retest to $99,000.

This Bitcoin Market Dynamic Commands Attention as Prices Surge Past $110K Ahead of $13B Options Expiry (CoinDesk): With $13 billion in options expiring Friday, dealer hedging is likely to force buying on upticks and selling on dips near key levels, creating self-reinforcing swings that may overwhelm fundamentals.

Despite recent price drops, the Bitcoin futures market shows resilience. Open interest has slightly increased to $27.2 billion, indicating minimal liquidations and quick buyer re-entry. Normalized funding rates suggest underlying market strength and a less volatile sentiment.

Overall, while the crypto market faces short-term headwinds from macroeconomic factors and derivative pressures, underlying metrics suggest potential for continued growth and stability. Investors should remain vigilant and informed, carefully monitoring market movements and regulatory developments.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Crypto markets experienced volatility following cautious remarks from the Federal Reserve regarding future interest rate cuts. Bitcoin is trading below its all-time high, with analysts pointing to muted enthusiasm and significant options expiry as contributing factors.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.