Spot XRP ETFs have seen impressive inflows, signaling strong institutional interest. Technical indicators like RSI divergence and TD Sequential point to potential bullish momentum for XRP. Breaking the $2.20-$2.50 resistance range is crucial for XRP to target higher price levels.

What to Know:

- Spot XRP ETFs have seen impressive inflows, signaling strong institutional interest.

- Technical indicators like RSI divergence and TD Sequential point to potential bullish momentum for XRP.

- Breaking the $2.20-$2.50 resistance range is crucial for XRP to target higher price levels.

The digital asset XRP is garnering attention as spot exchange-traded funds (ETFs) tracking its price continue to attract significant inflows. This development occurs amid a broader regulatory landscape that is gradually becoming more accommodating toward crypto assets, making it an opportune time to assess XRP’s potential trajectory. For institutional investors and active traders, these inflows, coupled with emerging technical signals, present a compelling case for a closer look at XRP.

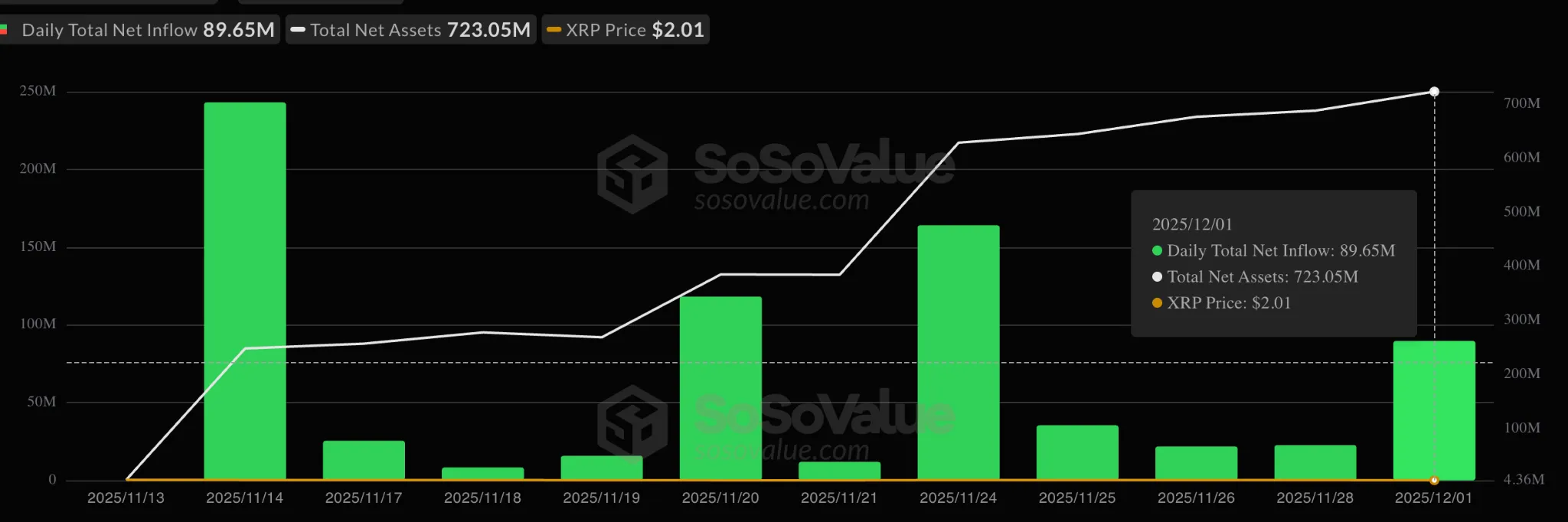

Spot XRP ETFs have been on a roll, recording eleven consecutive days of inflows. Data indicates that these ETFs have absorbed over $756 million since their launch. This consistent demand underscores growing institutional appetite for XRP exposure. The ETF inflows are particularly noteworthy when compared to other digital assets, outpacing even Solana ETFs and occurring against a backdrop of smaller Bitcoin ETF inflows. This suggests a specific interest in XRP, potentially driven by factors such as its relative undervaluation or anticipation of future regulatory clarity.

Currently, four XRP ETFs are live, with Canary’s XRPC on Nasdaq leading with $350 million in cumulative net inflows, followed by Bitwise’s XRP ETF at $170 million. The entrance of major players like Vanguard, with its $11 trillion in assets under management, further validates the institutional interest in crypto ETFs. Vanguard’s decision to allow its 50 million clients to trade crypto ETFs, including XRP ETFs, marks a significant shift in the investment landscape, potentially unlocking substantial capital flows into the asset class. This is reminiscent of the early days of gold ETFs, which saw a surge in demand as they provided a convenient and regulated way for investors to gain exposure to the precious metal.

🔥 HUGE: Vanguard now allows its clients to access crypto ETFs on its platform starting Tuesday, reversing its previous stance against digital assets. pic.twitter.com/fIhVNrC4ha

— Cointelegraph (@Cointelegraph) December 1, 2025

Technicals are also aligning to support a potential XRP rally. A bullish divergence between the relative strength index (RSI) and the XRP price on the daily chart suggests that bearish momentum is waning. This divergence, which has been building for over 55 days, indicates that despite the price making lower lows, the underlying strength is increasing, signaling a possible trend reversal. Seasoned traders often view such divergences as early indicators of a shift in market sentiment, prompting them to accumulate positions in anticipation of a breakout.

Adding to the bullish outlook, the TD Sequential indicator is flashing a buy signal on XRP’s weekly chart. Historically, this indicator has been a reliable predictor of XRP rallies, with past signals preceding gains ranging from 37% to as high as 174%. The TD Sequential, which identifies potential trend reversals based on intraday highs and lows, suggests that XRP could rebound significantly from its current level, potentially reaching around $5.60. However, it’s crucial to acknowledge that technical indicators are not foolproof and should be used in conjunction with other forms of analysis, including fundamental and on-chain metrics.

However, XRP faces stiff resistance between $2.20 and $2.50, a level reinforced by the 50-week simple moving average. Overcoming this resistance is essential for XRP to sustain its upward momentum and target higher price levels. A decisive break above this range could pave the way for a test of the psychological $3 level, potentially attracting further institutional and retail interest. The ability of XRP to overcome this resistance will likely depend on continued ETF inflows and positive developments in the regulatory landscape.

In conclusion, the confluence of strong ETF inflows and bullish technical signals paints a potentially optimistic picture for XRP. The sustained institutional demand, as evidenced by the consistent ETF inflows, suggests a growing confidence in XRP’s long-term prospects. While technical indicators like RSI divergence and TD Sequential point to potential upside, overcoming the $2.20-$2.50 resistance range remains a critical hurdle. As always, investors should conduct thorough due diligence and consider their own risk tolerance before making any investment decisions.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Spot XRP ETFs have seen impressive inflows, signaling strong institutional interest. Technical indicators like RSI divergence and TD Sequential point to potential bullish momentum for XRP. Breaking the $2.20-$2.50 resistance range is crucial for XRP to target higher price levels.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.