Shiba Inu (SHIB) retraced its recent gains, highlighting the market’s sensitivity to broader macro uncertainties. XRP demonstrated relative strength by holding the $2 level, a key psychological anchor despite overall market weakness.

What to Know:

- Shiba Inu (SHIB) retraced its recent gains, highlighting the market’s sensitivity to broader macro uncertainties.

- XRP demonstrated relative strength by holding the $2 level, a key psychological anchor despite overall market weakness.

- Bitcoin’s ability to reclaim its daily Bollinger mid-band will likely determine the fate of a potential Santa Rally.

The first week of December has concluded with a market displaying characteristics reminiscent of late 2021, a period when crypto assets declined ahead of broader equity market corrections. This time, however, the backdrop is one of anticipated monetary easing, with inflation showing signs of slowing. Yet, asset prices are behaving as if the entire easing cycle has already been factored in, creating a divergence between expectation and reality that leaves the market vulnerable.

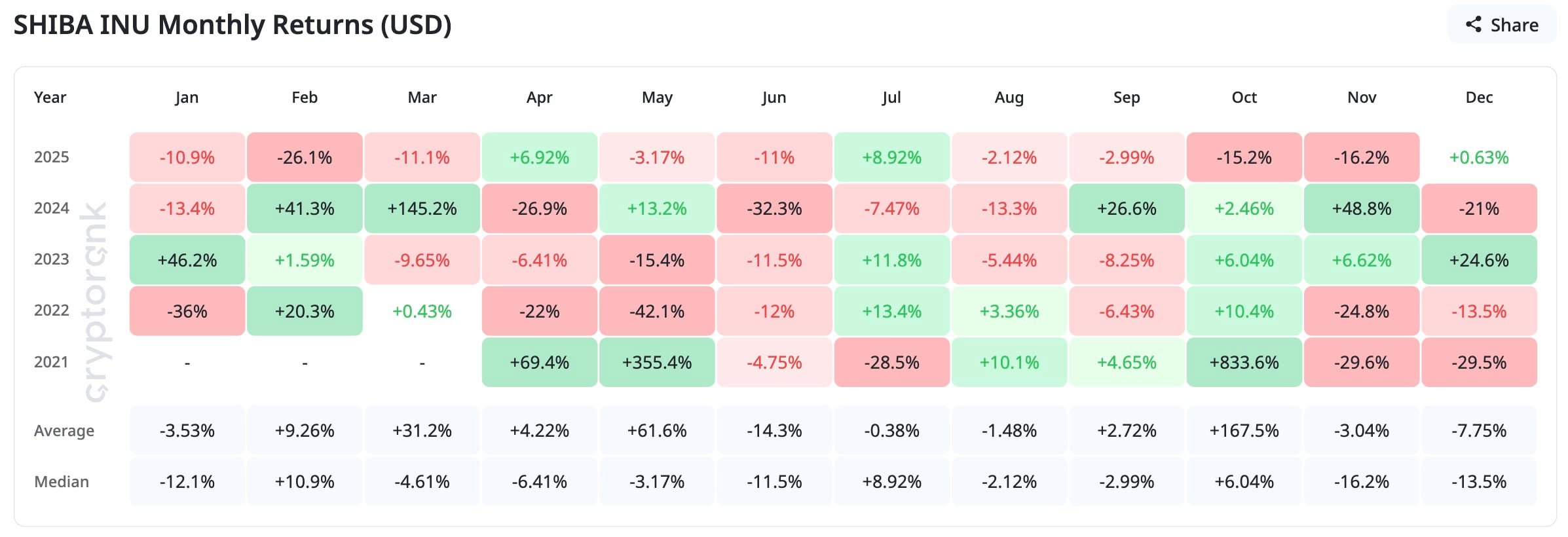

Shiba Inu’s December Dilemma

The week began with optimism surrounding Shiba Inu (SHIB), which had gained approximately 12% in the preceding two weeks. However, this bullish sentiment quickly evaporated as SHIB erased its gains, returning to the $0.0000084 level where the early-month rally began. This whipsaw action underscores the compressed cycles and diminished patience in speculative trades, where assets like SHIB lack the runway they typically require to sustain momentum. The question for investors now is whether to hold or sell, and the rational answer appears to be that there is no compelling reason to hold unless Bitcoin can demonstrate renewed strength.

XRP’s Relative Strength

Amidst the volatile crypto market, XRP exhibited a degree of controlled chaos. While it posted the weakest weekly performance among the top 10 cryptocurrencies at -7.24%, it managed to hold the $2 level. This is significant because in uncertain times, round numbers often serve as psychological anchors. Despite broader market pressures, XRP’s ability to maintain this level suggests a degree of underlying support, possibly driven by recent ETF inflows or simply a reluctance among holders to surrender a key sentiment-defining price point. The $2 level now acts as a gateway: a breach could trigger further downside, while holding it could allow XRP to capitalize on any Bitcoin upside.

Bitcoin’s Santa Rally Crossroads

Bitcoin is currently at a critical juncture that will determine its December trajectory. The daily Bollinger mid-band is acting as resistance, and Bitcoin is struggling to break above it. If Bitcoin can reclaim this level and close a weekly candle above it, the path towards $94,300 opens up. Failure to do so, however, could lead to a decline towards $84,400, shifting the focus to damage control rather than a seasonal rally. This technical setup is further complicated by broader equity market signals, where a downward move in the S&P 500 could trigger a significant valuation drawdown.

The Saylor Factor

Adding another layer of complexity is the “Saylor factor,” referring to MicroStrategy’s substantial Bitcoin holdings. Should equities decline, MicroStrategy’s leveraged exposure could become a pressure point. This is not just about potential liquidation risk, but also the erosion of the narrative that Bitcoin has an unshakeable corporate backer. Any weakening of this narrative could have an immediate impact on liquidity.

Navigating Market Uncertainty

The parallels between the current market environment and the fall of 2021 are hard to ignore. Crypto assets are once again leading the decline ahead of equities, while compressed cycles and inflated valuations suggest that the market has priced in the entire easing path prematurely. The upcoming Federal Reserve meeting poses a risk of resetting expectations and potentially triggering a broader market correction.

In summary, the crypto market is at a precarious point, with key assets facing critical technical levels. Bitcoin’s ability to overcome resistance, XRP’s defense of its psychological support, and the broader macro environment will all play a role in determining the market’s direction in the coming weeks. Investors should remain vigilant and prepared for potential volatility as the market navigates this period of uncertainty.

Related: XRP Ledger: CTO Highlights Three Key Drivers

Source: Original article

Quick Summary

Shiba Inu (SHIB) retraced its recent gains, highlighting the market’s sensitivity to broader macro uncertainties. XRP demonstrated relative strength by holding the $2 level, a key psychological anchor despite overall market weakness. Bitcoin’s ability to reclaim its daily Bollinger mid-band will likely determine the fate of a potential Santa Rally.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.