Corporate Bitcoin treasury activity is slowing as BTC faces a significant downturn from its October all-time high. While the number of companies holding Bitcoin increased throughout 2025, the pace of new entrants has diminished significantly in the fourth quarter.

What to Know:

- Corporate Bitcoin treasury activity is slowing as BTC faces a significant downturn from its October all-time high.

- While the number of companies holding Bitcoin increased throughout 2025, the pace of new entrants has diminished significantly in the fourth quarter.

- Strategy and Bitmine continue to accumulate BTC and ETH respectively, but other major players have paused their purchasing activity.

Bitcoin’s price correction from its October peak is impacting corporate treasury strategies, signaling a potential shift in institutional sentiment. The slowdown in new companies adding Bitcoin to their balance sheets, coupled with reduced accumulation from some existing holders, warrants a closer examination of market dynamics. Understanding these trends is crucial for institutional investors navigating the evolving landscape of digital asset adoption and risk management.

Slowing Inflows into Bitcoin Treasuries

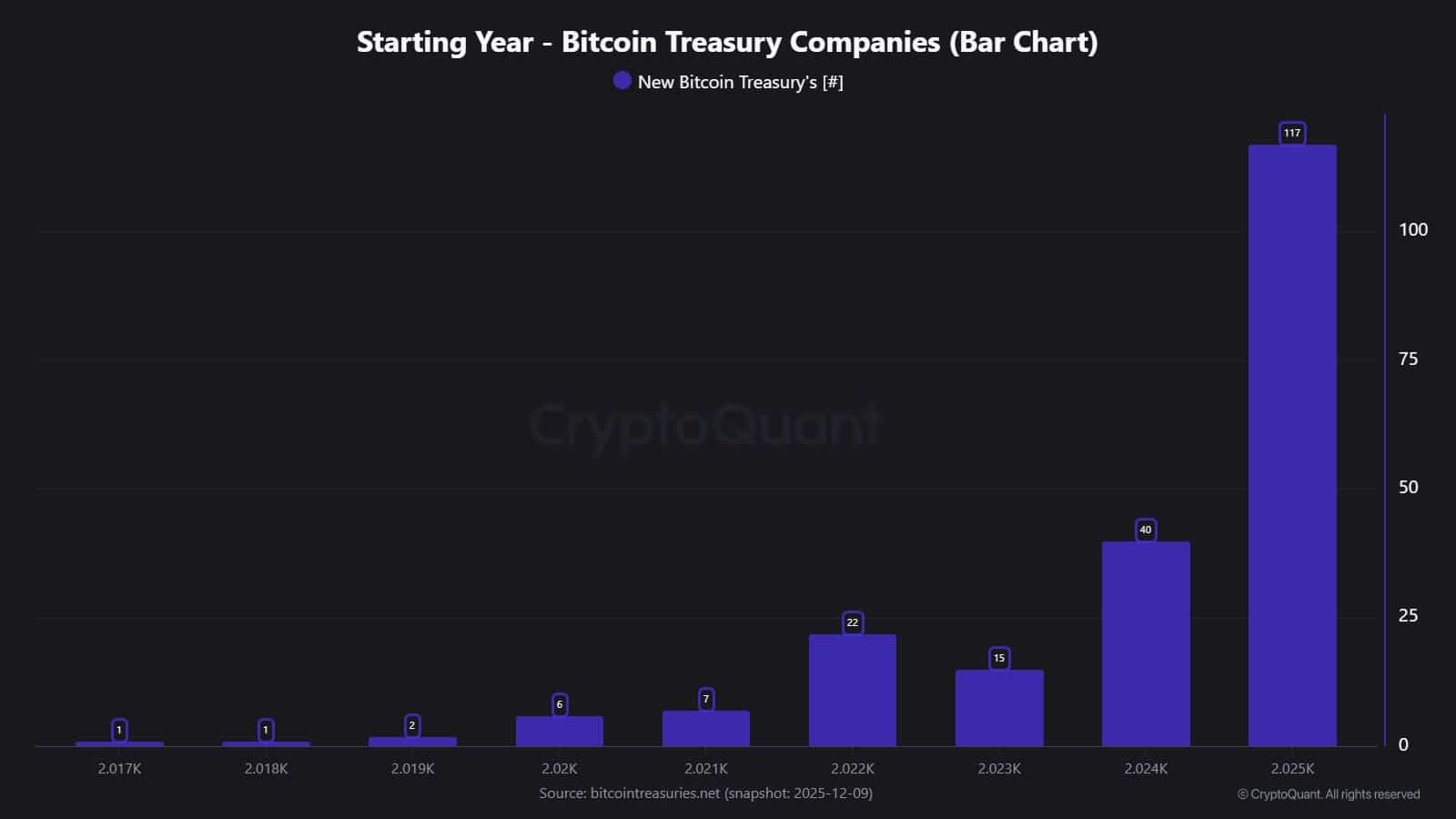

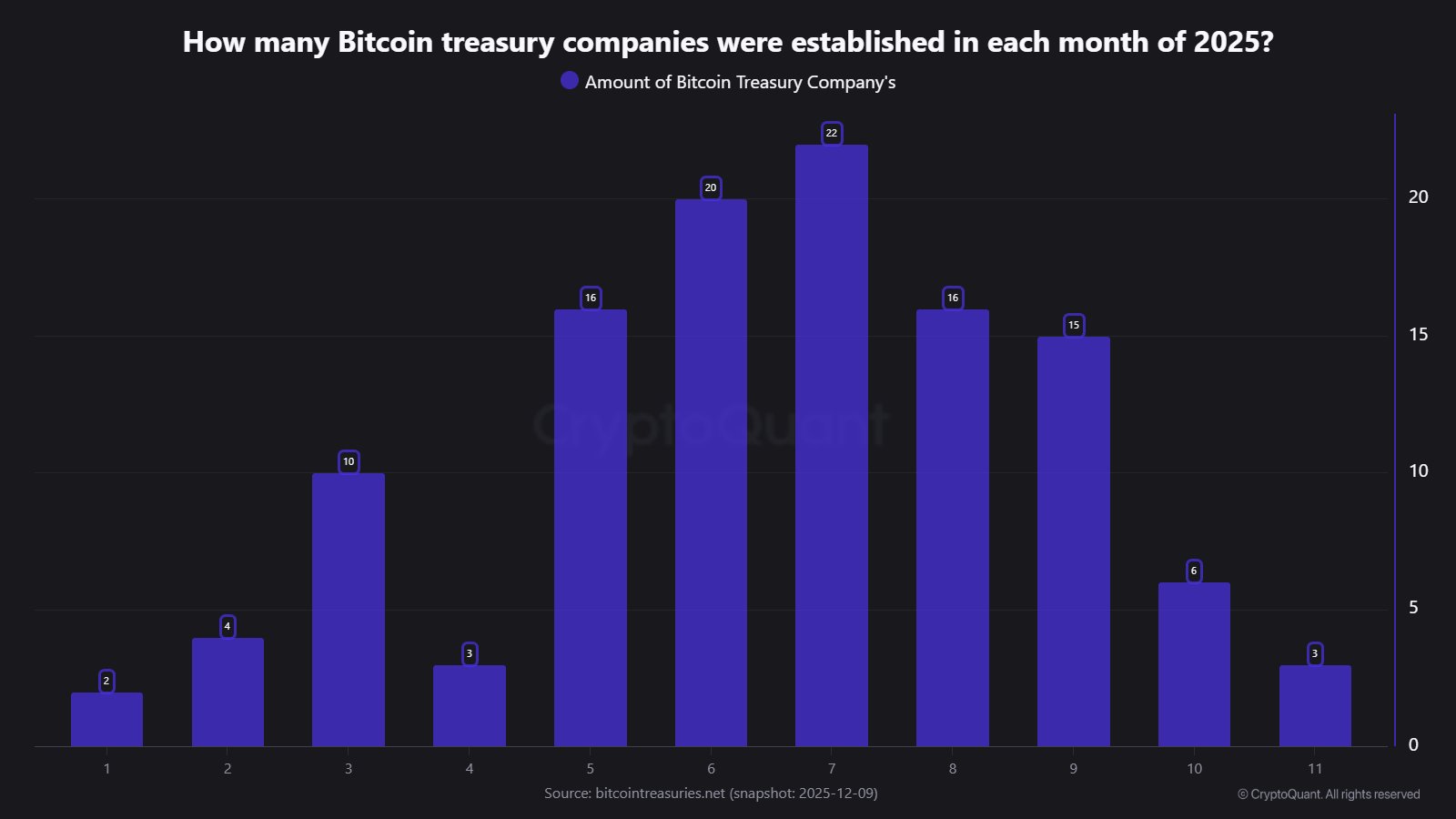

The number of companies adding Bitcoin to their balance sheets reached a high of 117 in 2025, but the pace of new entrants has slowed considerably, according to CryptoQuant data. After peaking in July, the number of new corporate Bitcoin treasuries has steadily declined, reflecting a cooling enthusiasm for holding BTC. This slowdown coincides with Bitcoin’s price struggles, suggesting a correlation between market performance and corporate adoption rates.

This decline in new Bitcoin treasury firms could indicate a broader reassessment of risk appetite among corporate investors. Similar patterns have been observed in previous market cycles, where periods of rapid price appreciation are followed by corrections and a subsequent pullback in institutional inflows. The current environment necessitates a more cautious approach, with investors closely monitoring macroeconomic conditions and regulatory developments.

Diverging Accumulation Strategies

While the overall trend shows a slowdown in new Bitcoin treasury firms, existing holders exhibit diverging strategies. Strategy has maintained a strong buying pace, nearly matching its 2024 accumulation. In contrast, Bitmine, a major Ethereum treasury company, has significantly reduced its ETH purchases in recent months. Other notable players like Metaplanet and Evernorth have paused their accumulation activity altogether.

The contrasting behavior of these major treasury holders suggests a more nuanced view of the market. Strategy’s continued accumulation signals strong conviction in Bitcoin’s long-term potential, while the reduced activity of others may reflect concerns about short-term price volatility or shifting investment priorities. This divergence highlights the importance of understanding individual company strategies and risk management frameworks.

Impact of Market Structure and Liquidity

The slowdown in corporate Bitcoin treasury activity could have implications for market structure and liquidity. Reduced buying pressure from corporate holders may contribute to increased price volatility and decreased market depth. This, in turn, could create challenges for institutional investors seeking to execute large trades or manage their portfolio risk.

The evolving market structure requires institutional investors to adapt their trading strategies and risk management practices. Increased reliance on derivatives markets, such as Bitcoin futures and options, may be necessary to hedge against price volatility and manage exposure. Additionally, access to deep and liquid trading venues is crucial for minimizing slippage and ensuring efficient execution.

Regulatory and Macroeconomic Considerations

Regulatory developments and macroeconomic conditions play a significant role in shaping corporate treasury strategies. Uncertainty surrounding regulatory clarity for digital assets may deter some companies from adding Bitcoin to their balance sheets. Additionally, rising interest rates and tighter monetary policy could reduce the attractiveness of Bitcoin as an alternative store of value.

Institutional investors must closely monitor regulatory developments and macroeconomic trends to assess their potential impact on Bitcoin’s price and adoption. A more favorable regulatory environment could spur increased institutional participation, while a more hawkish monetary policy stance could dampen demand for Bitcoin. Understanding these dynamics is essential for making informed investment decisions.

Derivatives Positioning and ETF Mechanics

The positioning of derivatives contracts, such as Bitcoin futures and options, can provide insights into market sentiment and potential price movements. A buildup of short positions could indicate bearish sentiment and increase the risk of a sharp price decline. Conversely, a concentration of long positions could suggest bullish sentiment and increase the likelihood of a price rally.

The mechanics of Bitcoin ETFs also play a crucial role in shaping market dynamics. The creation and redemption of ETF shares can impact the supply and demand for Bitcoin, influencing its price. Institutional investors must understand these mechanics to effectively manage their ETF holdings and anticipate potential market movements.

The slowdown in corporate Bitcoin treasury activity signals a potential shift in institutional sentiment, driven by price volatility, regulatory uncertainty, and macroeconomic headwinds. While some companies like Strategy continue to accumulate Bitcoin, others have paused their buying activity, reflecting a more cautious approach. Navigating this evolving landscape requires a deep understanding of market structure, derivatives positioning, ETF mechanics, and regulatory developments.

Related: XRP Forecasts Vary for New Year’s Eve

Source: Original article

Quick Summary

Corporate Bitcoin treasury activity is slowing as BTC faces a significant downturn from its October all-time high. While the number of companies holding Bitcoin increased throughout 2025, the pace of new entrants has diminished significantly in the fourth quarter.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.