Bitcoin steadied around $90,500 after a volatile week influenced by macro events. Altcoins showed mixed performance, with some experiencing significant price swings. Market stability is crucial for XRP, influencing liquidity and trading conditions.

What to Know:

- Bitcoin steadied around $90,500 after a volatile week influenced by macro events.

- Altcoins showed mixed performance, with some experiencing significant price swings.

- Market stability is crucial for XRP, influencing liquidity and trading conditions.

Cryptocurrency markets experienced a week of fluctuations, with Bitcoin finding support around $90,500. The market responded to both macroeconomic factors and altcoin-specific developments. This period of relative calm offers a moment to assess potential opportunities and risks in the crypto space, particularly for assets like XRP.

BTC Calms After Volatile Week

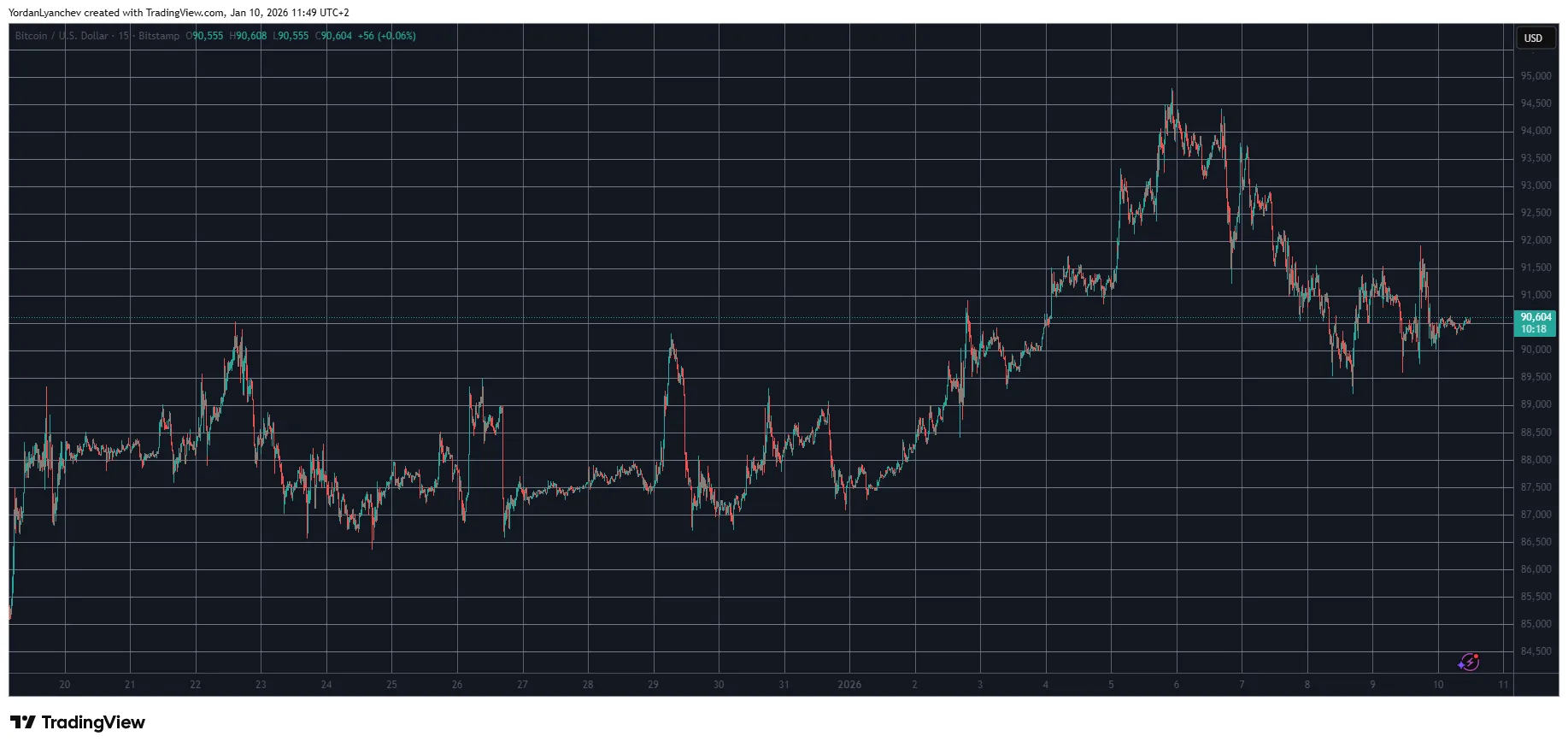

Bitcoin began the week with a surge, approaching $95,000 before facing rejection and subsequent declines. The price fell to around $89,000 before recovering to $92,000. Anticipation of a US Supreme Court decision on tariffs added to market uncertainty, but its delay resulted in relative price stability, with Bitcoin currently trading at $90,500. Bitcoin’s market capitalization is $1.810 trillion, with a dominance of 57%.

Altcoin Performance Mixed

The altcoin market presented a mixed picture. Ethereum (ETH) struggled below $3,100, while XRP showed vulnerability around the $2.10 mark. Solana (SOL) decreased to $136, and Dogecoin (DOGE) traded at $0.14. Zcash (ZEC) experienced a notable decline, falling 12% to $380. On the other hand, Polkadot (POL) saw a significant increase of 17%, reaching nearly $0.17. Other gainers included TAO and SUI, while Binance Coin (BNB) remained above $900, and Tron (TRX) approached $0.30.

XRP and Market Liquidity

XRP’s performance is closely tied to overall market liquidity and sentiment. Its ability to maintain levels above $2.00 is key for traders. Increased stability in Bitcoin and Ethereum could provide a more favorable environment for XRP, potentially attracting more liquidity. Any positive developments in Ripple’s ongoing legal battles could also positively influence XRP’s market position.

Broader Market Trends

The total cryptocurrency market capitalization has increased by approximately $20 billion, reaching $3.180 trillion. This indicates a general positive trend, potentially driven by increased institutional interest and the anticipation of spot Bitcoin ETF approvals. The performance of altcoins relative to Bitcoin also suggests evolving market dynamics and shifting investor preferences.

Implications for Institutional Investors

For institutional investors, the current market conditions present both opportunities and challenges. Bitcoin’s stabilization could be seen as a sign of growing maturity, attracting further institutional capital. However, the volatility in altcoins requires careful risk management and due diligence. Monitoring regulatory developments and technological advancements remains crucial for making informed investment decisions in the crypto space.

Conclusion

The cryptocurrency market is currently in a state of cautious optimism. Bitcoin’s stability provides a foundation for potential growth, while altcoins present selective opportunities for higher returns. Investors should remain vigilant, closely monitoring market trends and regulatory developments to navigate the evolving crypto landscape.

Related: XRP ETF Flows Show End of Ripple Era

Source: Original article

Quick Summary

Bitcoin steadied around $90,500 after a volatile week influenced by macro events. Altcoins showed mixed performance, with some experiencing significant price swings. Market stability is crucial for XRP, influencing liquidity and trading conditions. Cryptocurrency markets experienced a week of fluctuations, with Bitcoin finding support around $90,500.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.