A market technician predicts XRP may correct to $1.14 before a significant rally. This analysis is based on historical price patterns and Fibonacci levels. The prediction suggests potential accumulation zones for long-term XRP investors.

What to Know:

- A market technician predicts XRP may correct to $1.14 before a significant rally.

- This analysis is based on historical price patterns and Fibonacci levels.

- The prediction suggests potential accumulation zones for long-term XRP investors.

XRP has experienced a volatile start to 2026, marked by an initial surge followed by a sharp correction. After beginning the year with strong bullish momentum, XRP now faces considerable downward pressure. One analyst suggests that the bottom for XRP in 2026 may not yet be in, forecasting a deeper correction before an eventual explosive surge.

Historical Price Bottoms

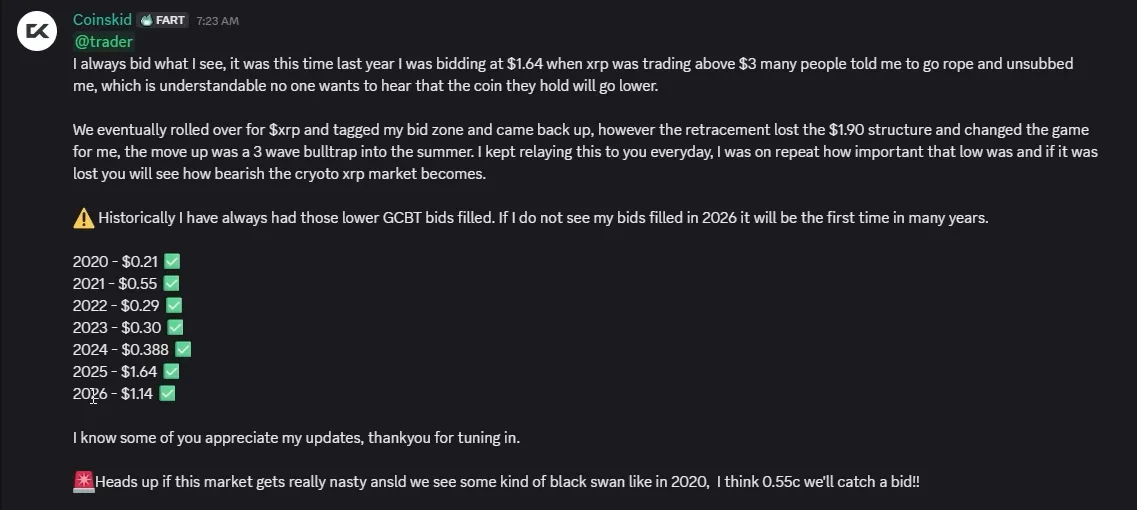

A prominent market technician known as CoinsKid recently shared insights into XRP’s historical price bottoms since 2020. According to the analyst, the bottoms were $0.21 in 2020, $0.55 in 2021, $0.29 in 2022, $0.30 in 2023, and $0.388 in 2024. These levels reflect broader market conditions, including bull and bear cycles and specific events like the Terra/Luna collapse and the FTX debacle. He noted that the 2025 bottom stood at $1.64, reached during a correction in April 2025.

2026 Bottom Target: $1.14

CoinsKid anticipates a lower bottom of $1.14 for XRP in 2026, suggesting the current retracement could lead to this level. He emphasized that these bottom prices represent potential bidding zones. The analyst faced criticism when he identified the $1.64 bottom last year when XRP was trading above $3, highlighting the challenges of making predictions in volatile markets.

Technical Analysis: Symmetrical Triangle Breakout

The $1.14 bottom target for 2026 is rooted in technical analysis. CoinsKid pointed to a 5-day XRP chart showing a breakout above a 7-year symmetrical triangle in November 2024. This breakout led to a rally to $3.4 in January 2025, which he identifies as the first wave of an Elliott Wave structure. The current correction after hitting resistance above $3 is considered Wave 2.

Fibonacci Levels and Correction Targets

CoinsKid believes XRP is currently undergoing an ABC correction within Wave 2. Despite the present weakness, he acknowledges that XRP’s macro setup appears favorable for continuation after the correction concludes. He suggests that if XRP loses its current structure and falls below $1.9, a steeper correction is likely, potentially reaching the Fib. 1.414 level. Historical corrections in 2015 and 2021 saw similar drops to this Fibonacci level.

Long-Term Price Target: $27

Following the correction, CoinsKid projects a recovery wave that could push XRP to $27, representing a 1,198% increase from the current price of $2.08. However, he acknowledges the speculative nature of these projections, admitting uncertainty about whether the bottom or top targets will materialize. This level would likely require significant shifts in market sentiment, regulatory clarity, and broader adoption of XRP and Ripple’s technologies.

While technical analysis can provide potential price targets, it’s essential to consider the inherent risks and uncertainties of the cryptocurrency market. Predictions should be viewed as possibilities rather than certainties, and investors should conduct thorough research before making any decisions.

Related: XRP Oversold? Analyst Reveals Potential Target

Source: Original article

Quick Summary

A market technician predicts XRP may correct to $1.14 before a significant rally. This analysis is based on historical price patterns and Fibonacci levels. The prediction suggests potential accumulation zones for long-term XRP investors.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.