Bitcoin breakout is generating renewed excitement across the crypto space, boosting interest in AI-themed and meme-based tokens while reinforcing the digital asset’s reputation as a hedge against economic uncertainty.

Bitcoin breakout is generating renewed excitement across the crypto space, boosting interest in AI-themed and meme-based tokens while reinforcing the digital asset’s reputation as a hedge against economic uncertainty.

This week began with Bitcoin climbing sharply above $87,000, breaking out of its recent trading range between $83,000 and $86,000. This price movement comes amid speculation regarding U.S. political pressures on the Federal Reserve, stoking fears over central bank independence under a potential second Trump administration. Reports suggest President Trump is considering removing Fed Chair Jerome Powell, prompting a selloff in the U.S. dollar and surging demand for alternative assets like gold and Bitcoin.

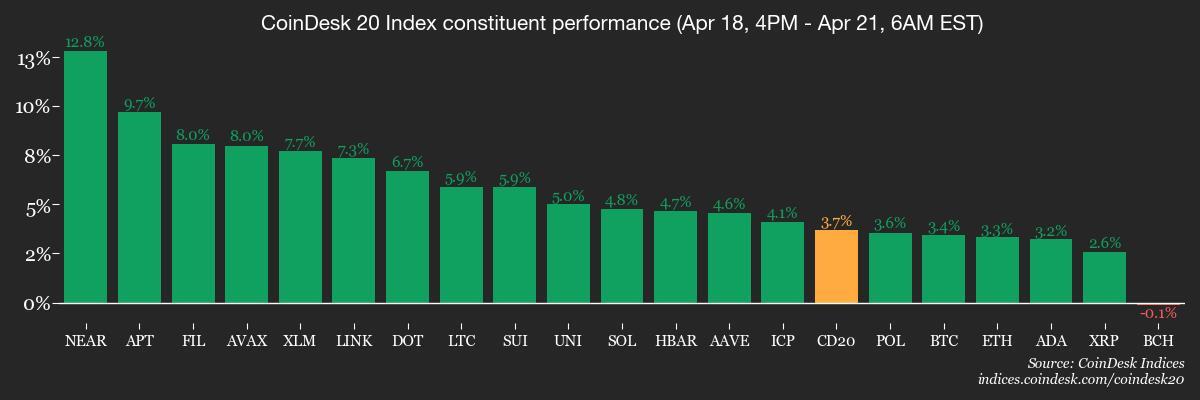

The markets quickly reacted, with the U.S. Dollar Index plunging to a three-year low of 98.00, while gold soared past $3,400 per ounce. At the same time, Bitcoin’s surge pulled much of the crypto market with it. AI and gaming tokens such as ENJ and MAGIC posted impressive 50% gains within 24 hours, reflecting strong investor appetite for high-growth sectors within decentralized finance. However, not every token shared the upside—MANTRA dropped 15% despite the broader rally.

Matrixport, a digital asset platform, said the weakening dollar could heighten demand from U.S.-based investors seeking store-of-value assets like Bitcoin. With inflation concerns looming and centralized financial systems appearing increasingly volatile, Bitcoin’s decentralized structure offers an attractive alternative.

Blockchain analytics firm IntoTheBlock noted that as Bitcoin eyes the $90,000 threshold, on-chain signals imply low resistance in this area. “Cost basis clusters”—regions with relatively few sellers—could mean rapid price advances until holders begin profit-taking en masse.

In institutional news, Charles Schwab CEO Rick Wurster hinted at the company’s intention to roll out spot crypto trading sometime in the next 12 months. Interest from clients continues to grow, he said, marking a shift in how mainstream finance is warming up to digital assets.

Meanwhile, Slovenia’s Finance Ministry proposed a 25% tax on crypto capital gains, which could affect both retail trading and day-to-day token use. That policy would begin in 2026, pending approval.

Ethereum faced mixed signals this week. Co-founder Vitalik Buterin proposed migrating from the Ethereum Virtual Machine (EVM) to the RISC-V architecture to improve smart contract performance. However, Ethereum briefly fell below Solana in total value staked, raising concerns among its community. Uniswap’s founder warned that Ethereum risks falling behind if it fails to scale effectively.

Amid rising volatility, derivatives markets also saw increased activity. Futures open interest climbed to $37.22 billion—the highest since March—led by Ethereum, followed by Bitcoin and LINK. ETH’s cumulative volume delta turned positive, suggesting increased buying interest versus selling pressure.

The week also featured updates to forthcoming events and protocols. Coinbase Derivatives plans to list XRP futures, pending CFTC approval. Additionally, ProShares expects its XRP ETF to begin trading on April 30. Upcoming governance events include proposals from Aave DAO involving Ether.fi and several token airdrops and unlocks scheduled for the end of April.

Other market news included continued fallout from Bitget’s trading platform. The exchange will roll back certain VOXEL trades after identifying suspicious market activity attributed to its automated systems. Users impacted by the manipulated trading will be compensated, according to Bitget.

Bitcoin’s dominance remains strong at 64%, with trading volumes showing signs of cautious optimism despite a muted rally in broader participation. Technical analyses point to the possibility of Bitcoin advancing toward the $90,000–$92,000 range, though lower volumes could pose risks of a short-term reversal.

Elsewhere, macroeconomic developments also influence sentiment. China’s latest announcement warns of retaliatory measures against U.S.-aligned trade policies, while domestic inflation signals could pressure central banks globally.

In crypto equities, trading for Coinbase (COIN), Marathon Digital (MARA), and Riot Platforms (RIOT) reflected this week’s bullish momentum. Most major firms saw modest gains in pre-market trading, suggesting increased confidence in blockchain-exposed companies.

Related: $2.3 Trillion Liquidity Shock: Franklin Templeton Says XRP Is Next in Line for Massive Inflows

As Bitcoin shows resilience and continues to attract investors amid monetary instability, its role as a digital hedge becomes more apparent. The crypto landscape, driven by evolving policies and technological innovations, appears to be entering a phase of renewed enthusiasm with Bitcoin at its helm.

Quick Summary

Bitcoin breakout is generating renewed excitement across the crypto space, boosting interest in AI-themed and meme-based tokens while reinforcing the digital asset’s reputation as a hedge against economic uncertainty. This week began with Bitcoin climbing sharply above $87,000, breaking out of its recent trading range between $83,000 and $86,000.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.