Ethereum price drop has sparked renewed concerns about its ability to maintain its dominance in the crypto industry. With its standing slipping among other digital assets, many are questioning whether Ethereum (ETH) still holds a vital position in the future of decentralized finance.

Ethereum price drop has sparked renewed concerns about its ability to maintain its dominance in the crypto industry. With its standing slipping among other digital assets, many are questioning whether Ethereum (ETH) still holds a vital position in the future of decentralized finance.

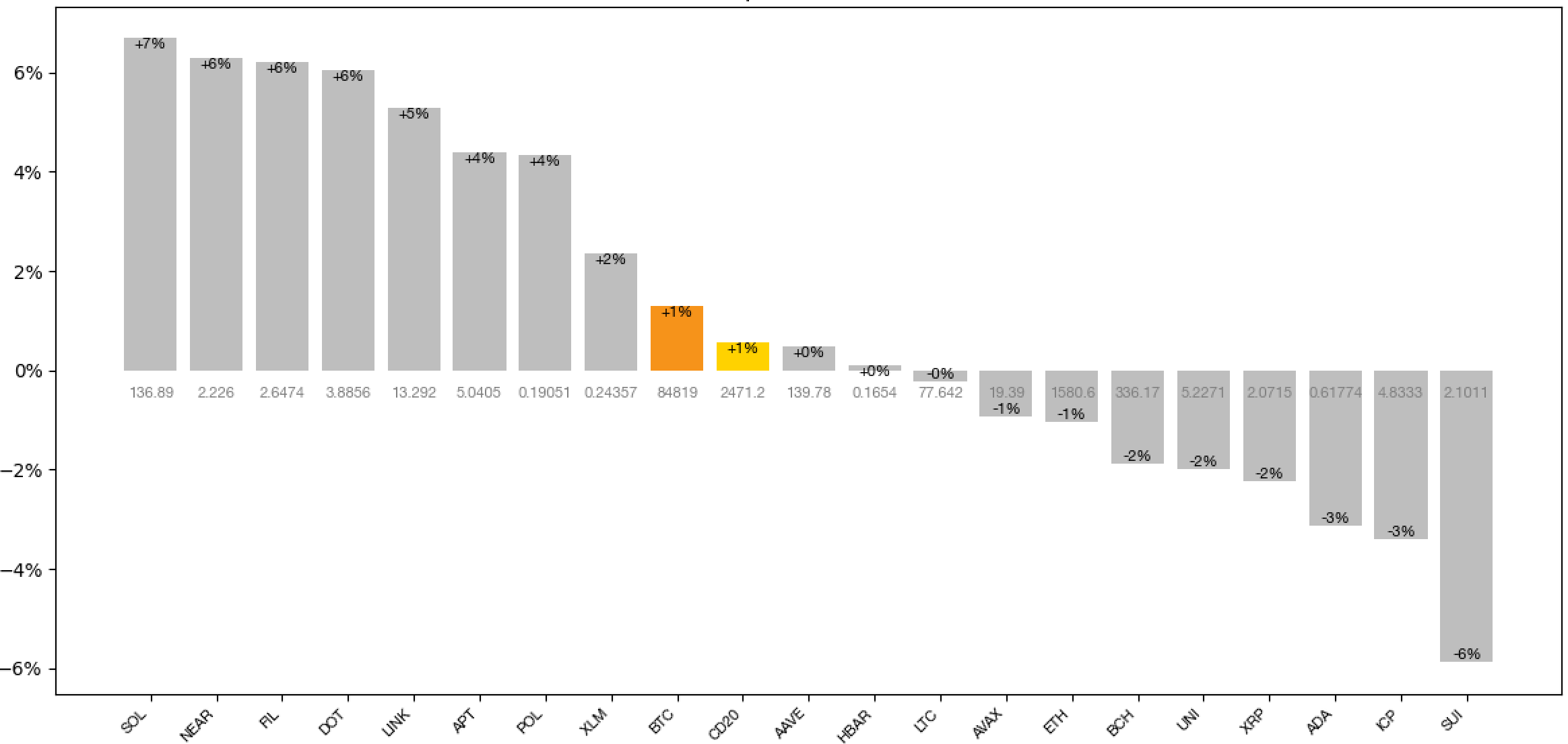

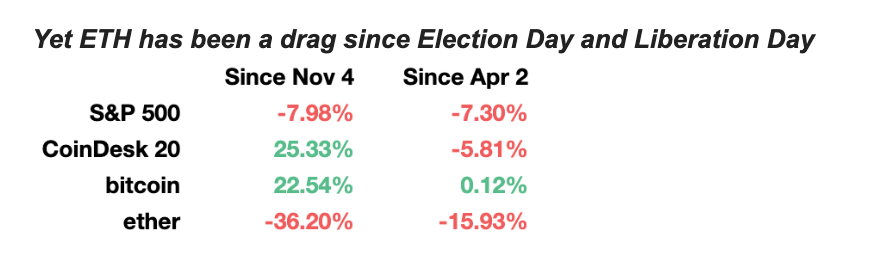

As of now, ETH is underperforming significantly in CoinDesk’s 2025 year-to-date (YTD) performance index, ranking a low 16th place with a staggering 53% decline. The broader picture isn’t any brighter — extending back twelve months, Ethereum still sits at 15th place with a nearly 50% drop. Even more concerning is that its market share has contracted so severely that it’s expected to be capped in the upcoming CoinDesk 20 index reconstitution, a move that positions it on par with XRP for the first time ever.

This downturn is no surprise to most in the blockchain community. As professionals building indices and financial products for the so-called “5%-ers” — experienced investors deeply involved in crypto — these metrics prompt a sobering reflection: does Ethereum still possess the uniqueness that once made it indispensable?

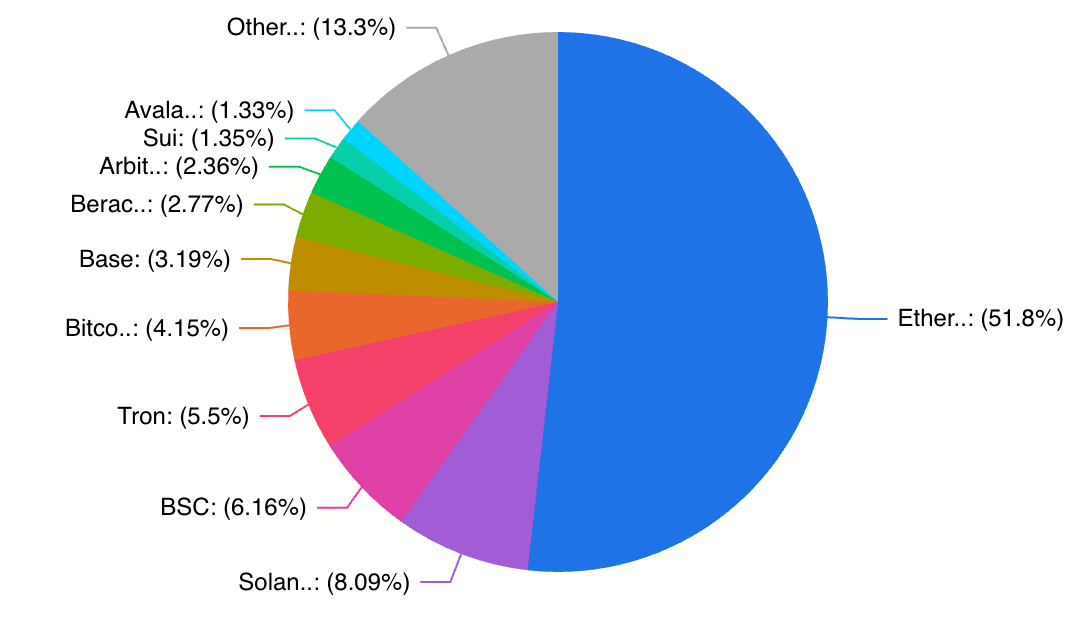

To be fair, Ethereum remains a giant within its core segments. It continues to reign supreme in the decentralized finance (DeFi) arena, not counting its Layer 2 (L2) extensions, and enjoys strong brand recognition, arguably second only to Bitcoin. Thought leaders in the space still see ETH playing a vital role in the eventual structure of Web3, with phrases like “Ethereum will be the clearinghouse of DeFi” still echoing in strategic discussions.

However, these accolades may not be enough. What Ethereum currently lacks is a compelling growth narrative. Without it, mainstream adoption will likely stall. Growth stories are what attract traditional investors, and for them to pour into Ethereum, there has to be momentum or, at the very least, strong signals of a recovery.

Contrast this with Bitcoin, which has demonstrated considerable resilience in the face of global financial uncertainties. Recent weeks, including the past one, have shown that Bitcoin is holding strong, even as expectations for rising inflation intensify — a sentiment now shared by Federal Reserve Chair Jerome Powell. These macroeconomic signals have historically worked in Bitcoin’s favor, pushing capital in its direction.

Still, there’s a hope that the cryptocurrency market can evolve beyond its current Bitcoin dependency. Ethereum had a brief moment of resurgence following the 2024 U.S. elections — a period when it managed to steer market enthusiasm. There’s no reason it can’t reclaim that leadership again.

If Ethereum does not step up, however, CoinDesk 20 index participants are not without alternatives. Many of them have allocations in assets that compete directly with Ethereum, especially in the DeFi space. The implication is clear: ETH’s dominance is under real threat, not just from market fluctuation but from credible challengers eager to fill the void.

Related: $2.3 Trillion Liquidity Shock: Franklin Templeton Says XRP Is Next in Line for Massive Inflows

Ethereum price drop is more than a temporary market blip — it’s a wake-up call. The network’s long-standing strengths in DeFi and smart contract infrastructure aren’t going away, but they’re also not enough to shield it from investor doubt. For Ethereum to remain a cornerstone of the crypto ecosystem, it needs a refreshed narrative, renewed leadership, and a clear path forward. Without these, its claim to being ‘special’ may fade into nostalgia.

Quick Summary

Ethereum price drop has sparked renewed concerns about its ability to maintain its dominance in the crypto industry. With its standing slipping among other digital assets, many are questioning whether Ethereum (ETH) still holds a vital position in the future of decentralized finance.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.