According to an announcement from Ripple’s core development team Ripplex, developers have introduced the first step toward Ethereum Virtual Machine (EVM) compatibility with the XRP-based sidechain XRPL.

According to an announcement from Ripple’s core development team Ripplex, developers have introduced the first step toward Ethereum Virtual Machine (EVM) compatibility with the XRP-based sidechain XRPL. The XRPL is now live on Devnet and developers can “assess available technologies,” alongside deploying “existing Solidity apps on the EVM sidechain.”

Ripple Core Developers and Peersyst Reveal First Phase of the EVM Sidechain XRPL

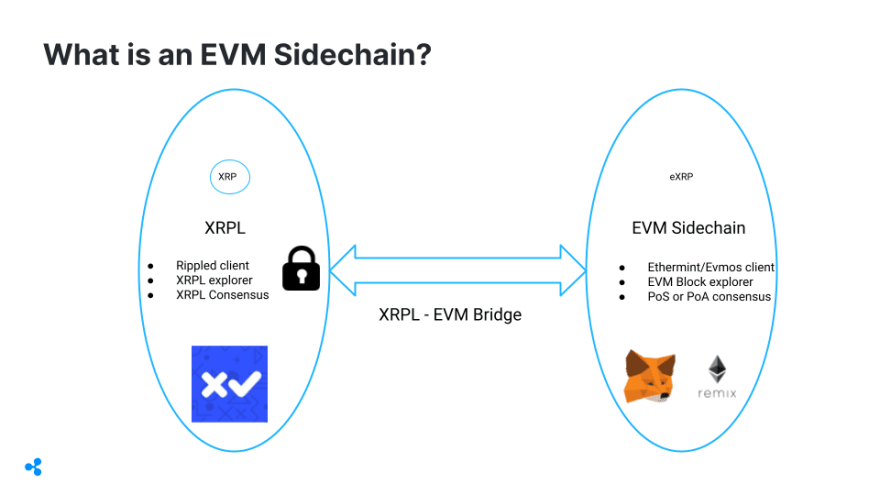

On Monday, October 17, Ripplex announced the introduction of the XRP-based and EVM-compatible side chain XRPL. The distributed ledger project XRP is the sixth largest crypto project by market capitalization, and XRP core developers have wanted to make the project compatible with smart contract processes for quite some time. Some accounts say XRP developer, David Schwartz, conceived the idea back in 1988. According to Ripplex, the XRPL chain is the first phase of the EVM sidechain and it’s being introduced by Peersyst Technology.

“This first phase of the EVM sidechain is currently available for testing on the XRPL Devnet,” the announcement details. “Using a bridge, developers can test the exchange of Devnet XRP between the EVM sidechain and XRP Ledger to: (1) Assess available technologies. (2) Deploy their existing Solidity apps on the EVM sidechain and access the XRPL Devnet userbase.”

Compatibility with Ethereum’s Virtual Machine has been addressed by a handful of alternative blockchain networks during the last few years. Phase two of XRPL will start in early 2023 and it will “feature a permissionless EVM sidechain and bridge,” the blog post written by Ripplex developer Mayukha Vadari details. “The end goal is phase three: a permissionless EVM sidechain and bridge available on the XRPL Mainnet slated to follow,” Vadari’s blog post explains. Vadari’s blog post further adds:

Throughout all three phases, the EVM sidechain will feature block and finality times comparable to the XRPL Mainnet and support Ethereum smart contracts and applications like Metamask, Remix, and Truffle.

Following the announcement, the native crypto asset xrp (XRP) is down 0.6% during the last 24 hours and 10.6% in seven days against the U.S. dollar. Despite recent losses, two-week stats show XRP is up 6%, and over the last month, XRP has gained 33.7%. Year-to-date, however, XRP has lost 58.1% in value against the U.S. dollar.

Source: coindesk.com

Related: $2.3 Trillion Liquidity Shock: Franklin Templeton Says XRP Is Next in Line for Massive Inflows

Quick Summary

According to an announcement from Ripple’s core development team Ripplex, developers have introduced the first step toward Ethereum Virtual Machine (EVM) compatibility with the XRP-based sidechain XRPL.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.