According to CoinShares’ latest cash flow report, XRP and Bitcoin were the only assets whose crypto products saw positive flows. Bitcoin-oriented investment products received $13.4 million and XRP $500,000.

According to CoinShares’ latest cash flow report, XRP and Bitcoin were the only assets whose crypto products saw positive flows. Bitcoin-oriented investment products received $13.4 million and XRP $500,000.

Investment products focused on other cryptocurrencies showed either an extremely weak performance or registered massive outflows. Overall, the market for cryptocurrency-oriented investment products ended the week with an inflow of $6.1 million.

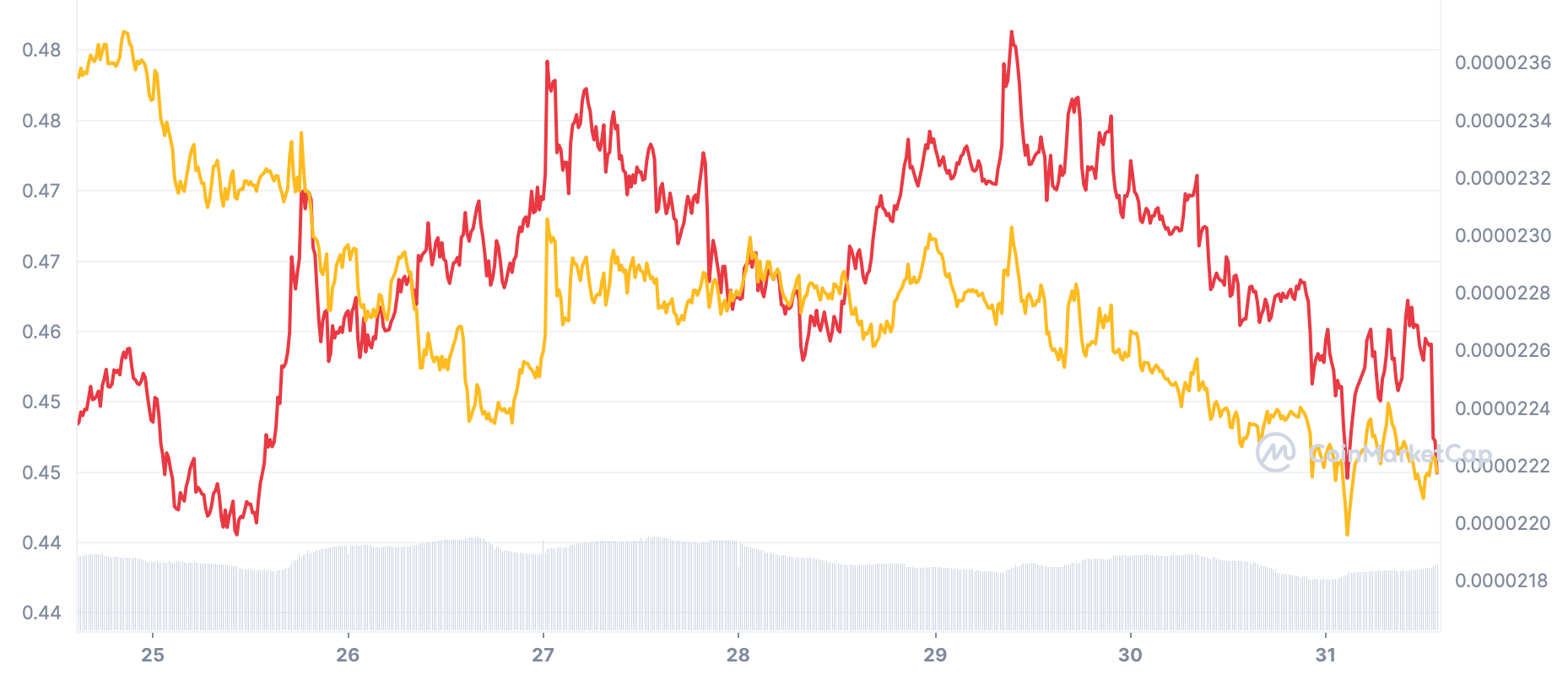

At the same time, the price action of both XRP and Bitcoin has been weak, despite the presence of activity on the targeted products. Yes, both cryptocurrencies traded on the plus side, but only by 2.5% to 5%, which is not much considering the performance of a number of coins at the end of last week.

BTC and XRP price action

As the trading session opened on the stock market, BTC quotations once again drew a Bart Simpson hairstyle, a pattern that has become familiar in recent months. As long as the S&P 500 remains below $3,900, a rise in the Bitcoin price should not be expected. The fact that the monthly candlestick closed today also puts additional pressure on the price.

XRP, for its part, continues to accumulate at the upper end of the price range where the token arrived back in early May. It is unlikely that XRP’s price action would differ from other cryptocurrencies were it not for the impending outcome of the legal battle between Ripple and the SEC. The exit from this accumulation will only show on the outcome of the trial.

Source: U.Today

Related: $2.3 Trillion Liquidity Shock: Franklin Templeton Says XRP Is Next in Line for Massive Inflows

Quick Summary

According to CoinShares’ latest cash flow report, XRP and Bitcoin were the only assets whose crypto products saw positive flows. Bitcoin-oriented investment products received $13.4 million and XRP $500,000. Investment products focused on other cryptocurrencies showed either an extremely weak performance or registered massive outflows.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.