XRP ETFs have seen unprecedented inflows, making it a shift in buyer behavior. Derivatives markets show sell-side aggression, contrasting with ETF demand. XRP’s price stability suggests a balance between passive inflows and active outflows.

What to Know:

- XRP ETFs have seen unprecedented inflows, marking a shift in buyer behavior.

- Derivatives markets show sell-side aggression, contrasting with ETF demand.

- XRP’s price stability suggests a balance between passive inflows and active outflows.

The crypto market has seen an unusual trend this month with XRP exchange-traded funds (ETFs) experiencing consistent inflows. These XRP ETFs have absorbed roughly $954 million over 18 consecutive trading sessions since launch, without a single outflow, signaling a new type of investor in the XRP space. This trend highlights the emergence of a buyer base distinct from the typical traders governing XRP’s liquidity cycles.

Ripple CEO Brad Garlinghouse describes this new investor group as “off-chain crypto holders,” indicating those who seek volatility exposure without the complexities of exchanges or self-custody. These investors purchase XRP similarly to how they invest in the S&P 500, utilizing regulated wrappers, custodial intermediaries, and tax-advantaged accounts. This shift reflects the increasing accessibility of digital assets within traditional brokerage platforms.

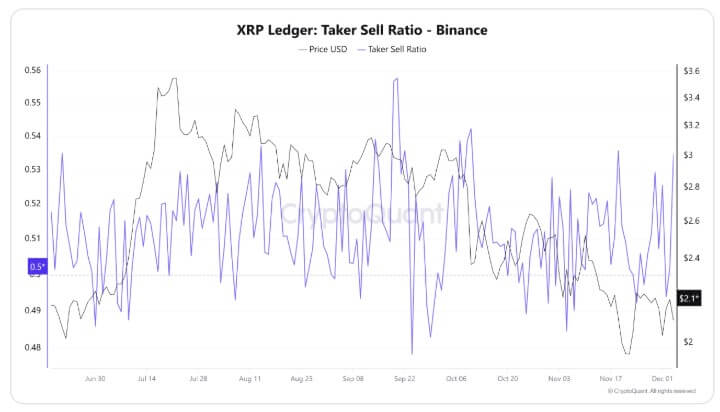

Despite the significant inflows into XRP ETFs, the asset’s price remains range-bound, suggesting that ETF demand is being offset by sellers elsewhere. Binance perpetual futures data indicates persistent sell-side aggression, with the Taker Sell Ratio at its highest level since mid-November. This divergence highlights a tension between passive ETF inflows and active selling pressure in the derivatives market.

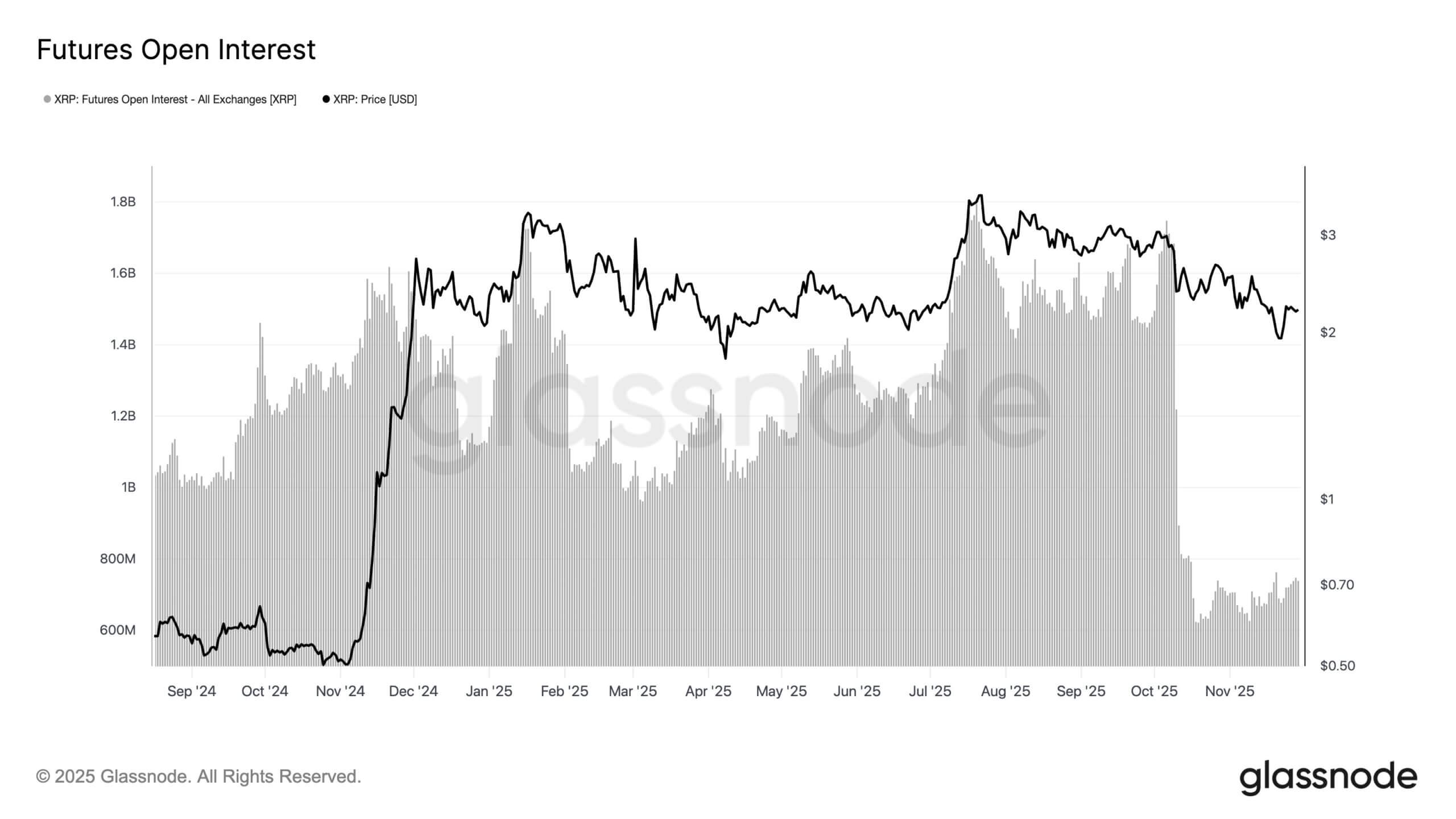

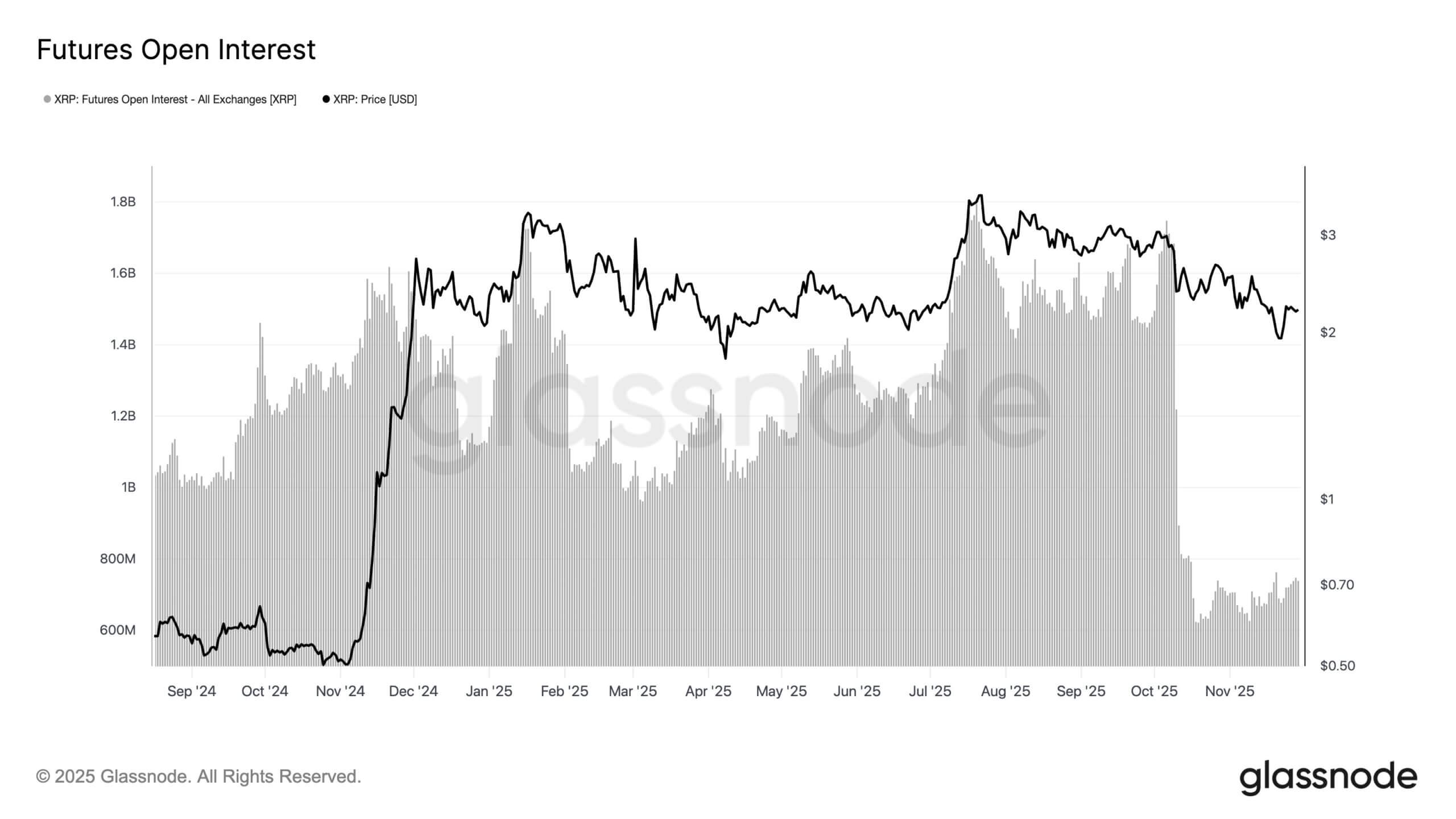

Glassnode data reveals a substantial decrease in futures open interest, falling from 1.7 billion XRP in early October to approximately 0.7 billion XRP, a 59% reduction. Additionally, funding rates have compressed, signaling a cooling speculative appetite for XRP. This suggests that the ETF bid is acting more as a buffer, absorbing supply that might otherwise drive the price lower, rather than acting as a catalyst for price appreciation.

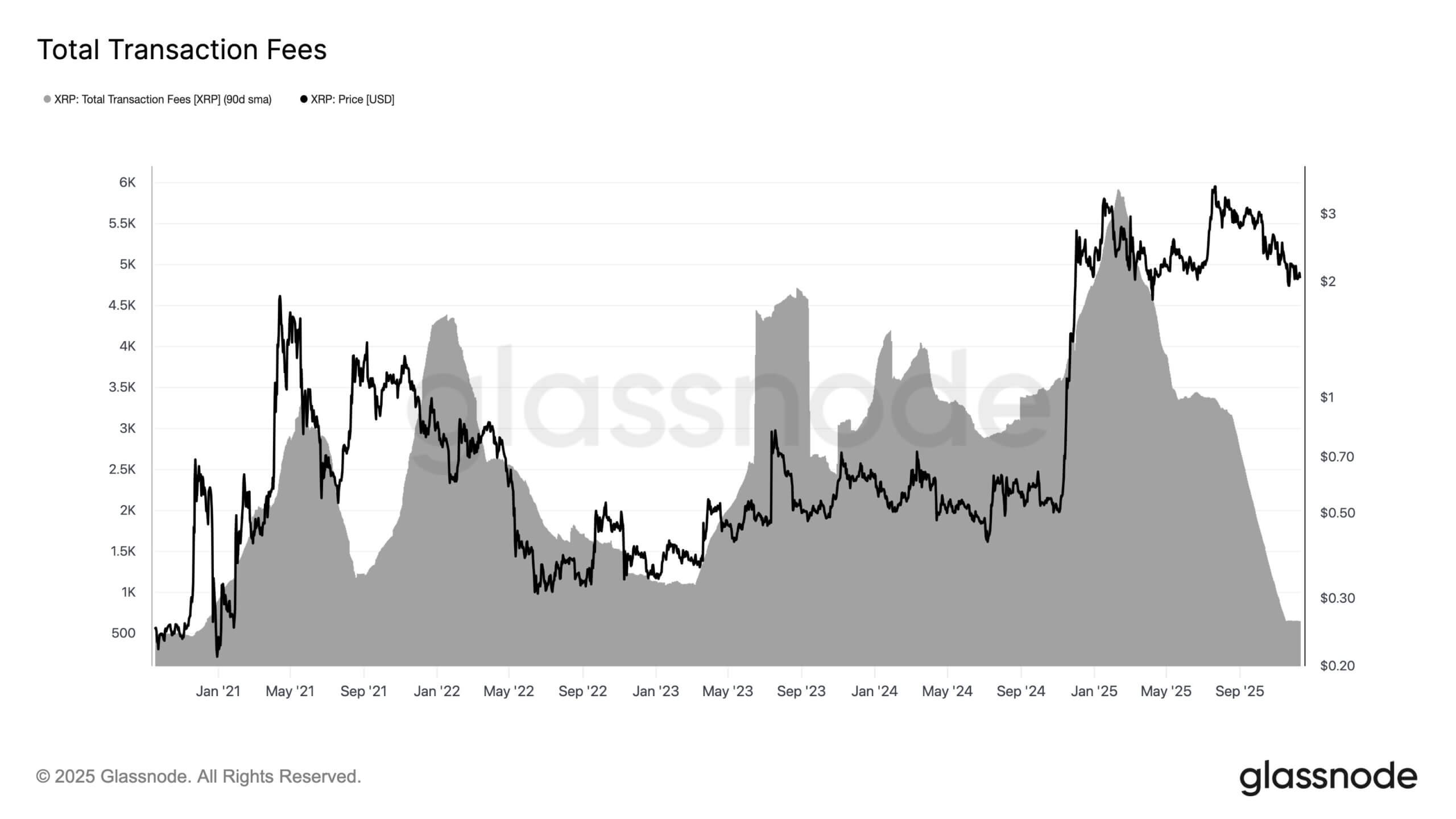

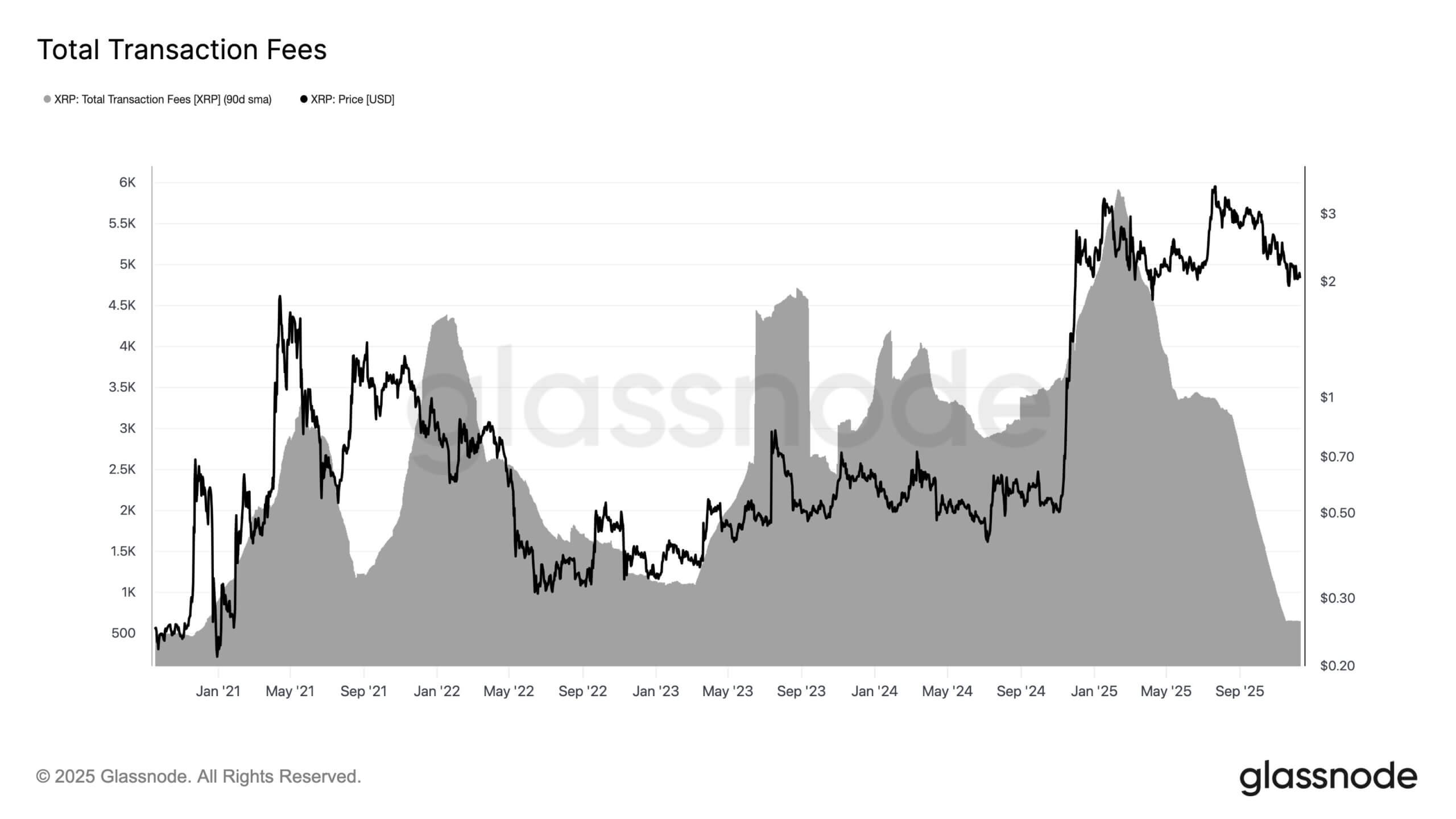

While ETF activity occurs off-chain, the XRP Ledger (XRPL) is also undergoing its own adjustments. Although network velocity has increased, transaction fees have significantly decreased, indicating efficient repositioning of assets rather than high-value settlements. This reflects a widening gap between financial demand, driven by ETFs, and operational demand on-chain, with price discovery increasingly anchored in regulated markets.

The emergence of a dual-track market, with passive allocators and crypto-native traders moving in opposite directions, presents a unique dynamic for XRP. For now, strong ETF inflows are countering speculative interest, but the sustainability of this balance remains uncertain. The situation with XRP offers a valuable case study of the interplay between traditional investment and crypto-native trading behaviors.

Related: Top Manager Sees XRP as Undervalued Opportunity

Source: Original article

Quick Summary

XRP ETFs have seen unprecedented inflows, marking a shift in buyer behavior. Derivatives markets show sell-side aggression, contrasting with ETF demand. XRP’s price stability suggests a balance between passive inflows and active outflows. The crypto market has seen an unusual trend this month with XRP exchange-traded funds (ETFs) experiencing consistent inflows.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.