The XRP Ledger (XRPL) is exploring the potential integration of staking mechanisms to enhance its role in the evolving DeFi landscape. Introducing staking could significantly alter XRP’s value profile, attracting new investors and increasing capital retention within the ecosystem.

What to Know:

- The XRP Ledger (XRPL) is exploring the potential integration of staking mechanisms to enhance its role in the evolving DeFi landscape.

- Introducing staking could significantly alter XRP’s value profile, attracting new investors and increasing capital retention within the ecosystem.

- Maintaining XRPL’s lean, incentive-free architecture would preserve XRP’s original purpose as a highly efficient bridge currency and settlement tool.

The XRP Ledger (XRPL) is at a crossroads as it considers integrating staking mechanisms to adapt to the yield-driven landscape of modern DeFi. Built in 2012, XRPL has always stood apart with its minimalist design, fast settlement, and deterministic consensus. Now, discussions about staking are reshaping how the asset is used and valued across the ecosystem.

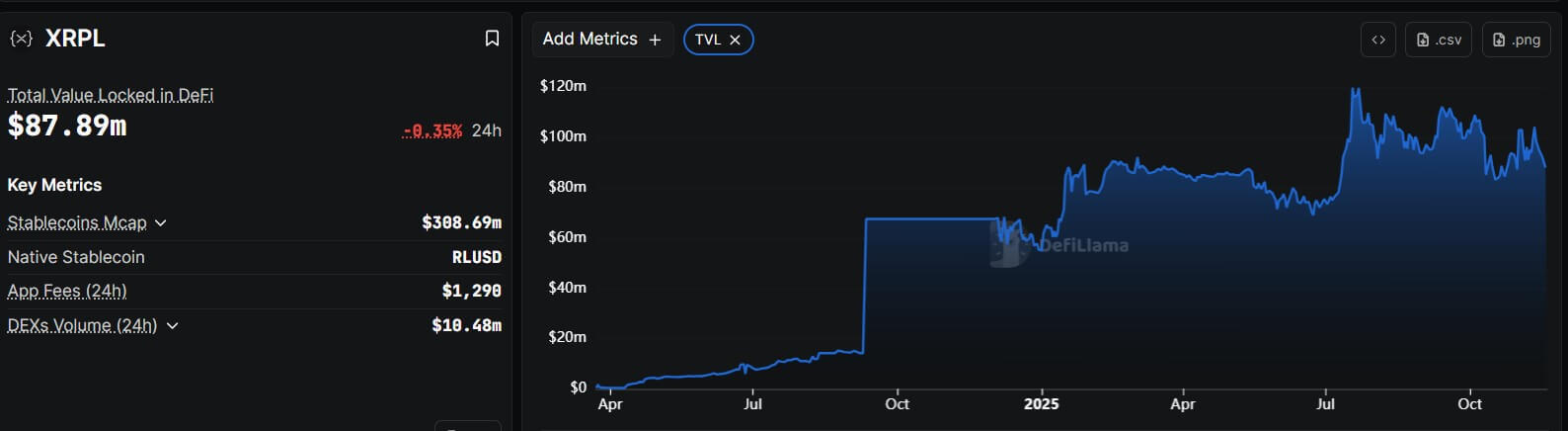

XRPL’s current architecture relies on a Proof of Association (PoA) consensus model with a Unique Node List (UNL) of trusted validators. Unlike other blockchains, XRPL lacks block rewards and slashing, focusing instead on network fees as anti-spam tools. This has made XRPL a trusted payments network, but its total value locked (TVL) is modest compared to ecosystems like Solana and Ethereum.

Introducing staking would require XRPL to find a source of rewards and distribute them without compromising decentralization. This could create tensions, as validators might develop financial motives conflicting with the network’s neutrality. Financial incentives could also lead to validator clustering, undermining XRPL’s distributed trust model.

“[Native staking] would change how value flows through the XRPL network in ways we’d need to think through carefully. So, talking about the idea for XRP helps us understand what could evolve and what should stay the same.”

Despite the challenges, XRPL users are seeking yield opportunities, leading to the growth of sidechains and bridges that wrap XRP. mXRP, a liquid staking token on XRPL’s EVM-compatible sidechain, exemplifies this trend, with significant TVL and expansion to other chains. This shows the market is building incentives that XRPL avoids, highlighting the dilemma of adapting to DeFi without losing core strengths.

The exploration of staking is less about the mechanism itself and more about defining XRP’s economic role in the future. Integrating even a limited form of native staking would fundamentally alter XRP’s value profile. This shift would attract new investors, deepen liquidity, and expand XRP’s role as collateral, potentially aligning it more closely with other productive tokens in the DeFi space.

In conclusion, the decision to introduce staking on the XRPL is a pivotal one that requires careful consideration. Balancing the need to remain competitive in the evolving DeFi landscape with the desire to preserve the qualities that have made it resilient is key. The outcome will not only shape the future of XRPL but also the economic future of XRP.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

The XRP Ledger (XRPL) is exploring the potential integration of staking mechanisms to enhance its role in the evolving DeFi landscape. Introducing staking could significantly alter XRP’s value profile, attracting new investors and increasing capital retention within the ecosystem.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.