Ripple unlocked 1 billion XRP from escrow, a routine event designed to strategically manage the token’s supply and mitigate potential market shocks. Despite the substantial unlock, XRP’s price demonstrated resilience, experiencing only a minor dip before recovering and establishing new local highs.

What to Know:

- Ripple unlocked 1 billion XRP from escrow, a routine event designed to strategically manage the token’s supply and mitigate potential market shocks.

- Despite the substantial unlock, XRP’s price demonstrated resilience, experiencing only a minor dip before recovering and establishing new local highs.

- Technical analysis suggests that if XRP sustains its current momentum, it could target the $2.33 level, coinciding with the upper curve of the Bollinger Bands on the daily chart.

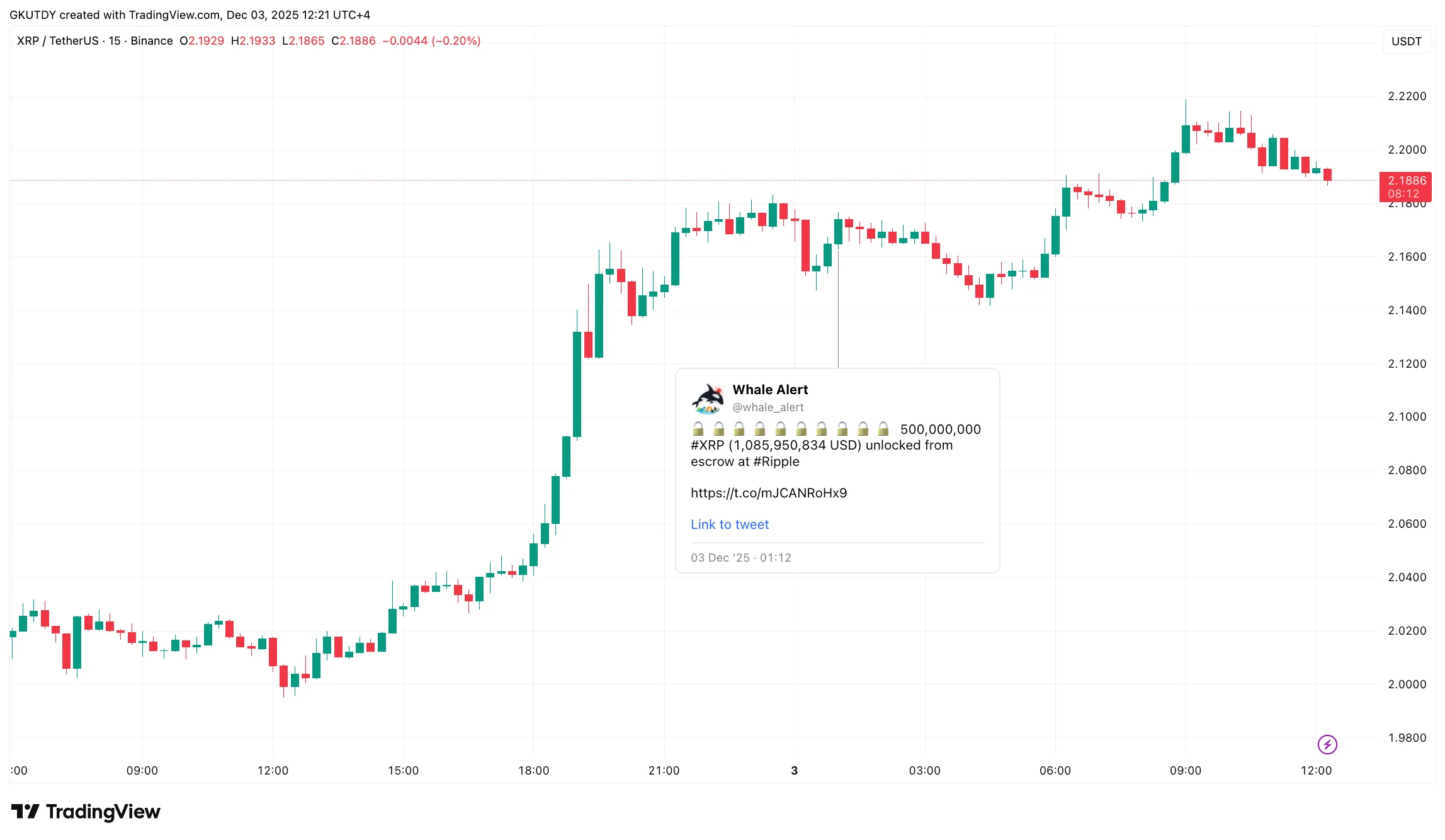

Ripple, the company closely associated with XRP, executed its monthly unlock of 1 billion XRP from escrow, valued at approximately $2.19 billion. This pre-scheduled event is part of Ripple’s strategy to manage the circulating supply of XRP. While such a large release could potentially flood the market and depress prices, the actual market reaction provides valuable insights into XRP’s current dynamics.

Scheduled Unlocks and Market Expectations

Ripple’s practice of monthly XRP unlocks is well-known in the digital asset space. These unlocks are intended to introduce XRP into the market gradually, preventing large-scale dumps that could destabilize the price. Typically, Ripple re-locks a significant portion of the released XRP, with recent trends showing around 600 million XRP being returned to escrow. The market has largely priced in these events, which explains the muted price reaction. This predictability reduces uncertainty and allows institutional investors to anticipate and adjust their positions accordingly.

Price Resilience and Market Sentiment

Despite the injection of 1 billion XRP into the market, the price of XRP showed remarkable resilience. Initially, there was a slight dip of 1.45% following the unlock announcement, but the price quickly recovered, eventually rising by over 3% to establish new local highs. This price action suggests underlying strength and positive market sentiment towards XRP. It indicates that buyers are absorbing the newly released tokens without significant disruption, reflecting confidence in XRP’s long-term prospects.

Technical Outlook and Potential Targets

From a technical analysis perspective, XRP’s ability to hold its gains is a bullish signal. If the current momentum continues, the next significant resistance level appears to be around $2.33, which aligns with the upper curve of the Bollinger Bands on the daily chart. This level could act as a potential target for traders and investors. However, it’s important to note that technical indicators are not foolproof, and market conditions can change rapidly. Monitoring trading volumes and order book depth will be crucial in assessing the likelihood of XRP reaching this target.

Institutional Implications and Market Structure

The way XRP’s price shrugged off this unlock event has broader implications for institutional adoption. It demonstrates that XRP’s market structure is becoming more robust and less susceptible to large-scale sell-offs. Institutional investors often look for assets with predictable behavior and strong liquidity. XRP’s ability to maintain its price despite the unlock event enhances its appeal to these investors. Furthermore, the ongoing regulatory clarity surrounding XRP, particularly following legal developments, is likely contributing to increased institutional interest.

Regulatory Landscape and Future Outlook

The regulatory landscape remains a critical factor for XRP. While Ripple has achieved some legal victories, the overall regulatory environment for digital assets is still evolving. Clear and consistent regulations are essential for fostering institutional adoption and ensuring market stability. As regulatory frameworks become more defined, XRP and other digital assets are likely to attract even greater institutional investment. The interplay between regulatory developments and market dynamics will continue to shape XRP’s future trajectory.

In conclusion, Ripple’s recent unlock of 1 billion XRP, while significant in volume, did not trigger a substantial price decline. Instead, XRP demonstrated resilience, suggesting growing market maturity and positive sentiment. The next key level to watch is $2.33, contingent on maintaining current momentum. This event underscores the importance of understanding market structure, regulatory factors, and institutional behavior in assessing the potential of digital assets like XRP.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Ripple unlocked 1 billion XRP from escrow, a routine event designed to strategically manage the token’s supply and mitigate potential market shocks. Despite the substantial unlock, XRP’s price demonstrated resilience, experiencing only a minor dip before recovering and establishing new local highs.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.