XRP faces near-term technical challenges as it tests critical support levels, requiring traders to monitor price action closely. Potential breakdown of support could trigger a deeper correction, highlighting the importance of risk management in XRP trading strategies.

What to Know:

- XRP faces near-term technical challenges as it tests critical support levels, requiring traders to monitor price action closely.

- Potential breakdown of support could trigger a deeper correction, highlighting the importance of risk management in XRP trading strategies.

- Longer-term outlook remains uncertain, with key levels needing to be defended to avoid a more significant downturn, reflecting broader market volatility.

XRP, the digital asset closely associated with Ripple Labs, finds itself at a pivotal juncture. As regulatory uncertainties continue to shape the landscape for cryptocurrencies, XRP’s price action is being closely watched by institutional investors seeking clarity and stability. The interplay between technical indicators and market sentiment will likely dictate XRP’s trajectory in the coming weeks.

Short-Term Technical Outlook

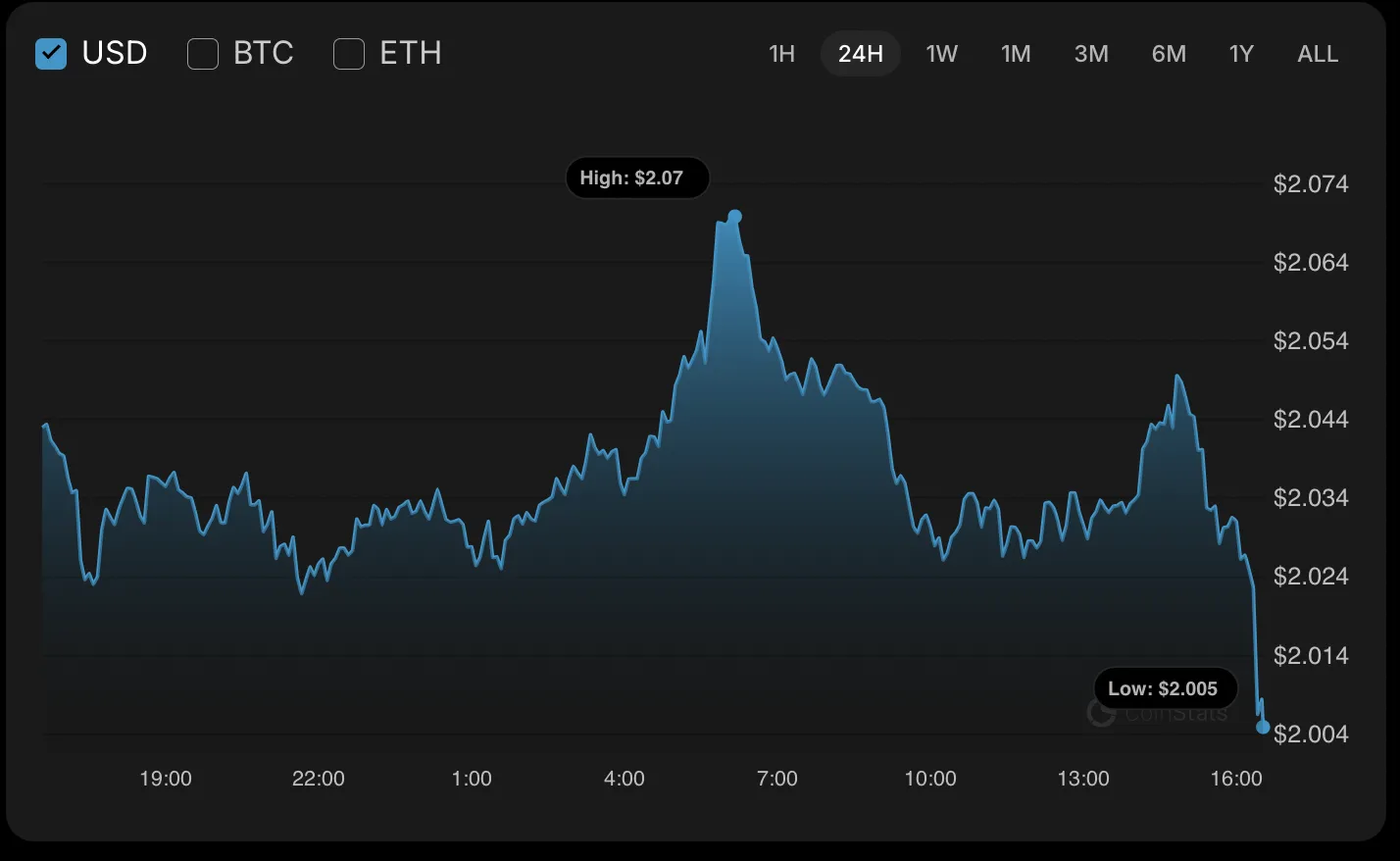

XRP has experienced a slight decline of 0.17% over the last 24 hours, signaling a potential weakening in its immediate price structure.

Hourly charts suggest a critical support level around $1.9894. A failure to hold this level could lead to further downward pressure, potentially driving the price towards $1.95. This scenario underscores the importance of monitoring short-term price movements and liquidity, as institutional traders often use these levels to gauge market sentiment and adjust their positions accordingly.

Critical Support Levels

Analysis of intraday charts reveals that XRP is testing the $1.9950 support level. A break below this point could accelerate the decline, potentially pushing XRP towards the $1.90 range.

This level is crucial, as a breach might trigger stop-loss orders and increase selling pressure. Institutional investors should be wary of such breakdowns, as they can lead to rapid price corrections. This dynamic is reminiscent of previous instances where key support levels failed, resulting in significant market pullbacks.

Mid-Term Trajectory

From a mid-term perspective, XRP’s charts do not currently show strong reversal signals. The focus remains on the $2 level; a weekly close below this threshold could signal a deeper correction towards the $1.4-$1.6 area.

This scenario would likely test the resolve of long-term holders and could lead to a reassessment of XRP’s valuation. Such corrections are not uncommon in the cryptocurrency market and often provide opportunities for strategic accumulation, provided the underlying fundamentals remain intact.

Broader Market Context

XRP’s price movements are influenced by broader market trends and regulatory developments. The ongoing legal battle between Ripple and the SEC continues to cast a shadow over XRP, impacting investor sentiment and trading activity.

Any positive resolution could act as a significant catalyst, potentially driving XRP’s price higher. Conversely, adverse rulings could exacerbate selling pressure. This regulatory overhang highlights the importance of staying informed and factoring legal risks into investment decisions.

Institutional Implications

For institutional investors, the current technical setup in XRP presents both risks and opportunities. The potential for a deeper correction necessitates a cautious approach, with a focus on risk management and position sizing.

However, a successful defense of key support levels could signal a buying opportunity, particularly for those with a long-term investment horizon. The ability to navigate these uncertainties will be crucial for institutions looking to capitalize on XRP’s potential.

Final Thoughts

As XRP navigates these technical challenges, investors should closely monitor price action and be prepared for potential volatility. The interplay between technical indicators, regulatory developments, and broader market sentiment will ultimately determine XRP’s near-term trajectory. Prudent risk management and a clear understanding of market dynamics are essential for successfully trading XRP in the current environment.

Related: XRP Ledger: CTO Highlights Three Key Drivers

Source: Original article

Quick Summary

XRP faces near-term technical challenges as it tests critical support levels, requiring traders to monitor price action closely. Potential breakdown of support could trigger a deeper correction, highlighting the importance of risk management in XRP trading strategies.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.