XRP’s social sentiment is currently in a “Fear” zone, contrasting with increasing on-chain activity. Despite negative retail sentiment, XRP ETFs are experiencing inflows, indicating institutional interest.

What to Know:

- XRP’s social sentiment is currently in a “Fear” zone, contrasting with increasing on-chain activity.

- Despite negative retail sentiment, XRP ETFs are experiencing inflows, indicating institutional interest.

- Ripple is strategically expanding its market footprint through acquisitions, aiming to enhance XRP’s utility.

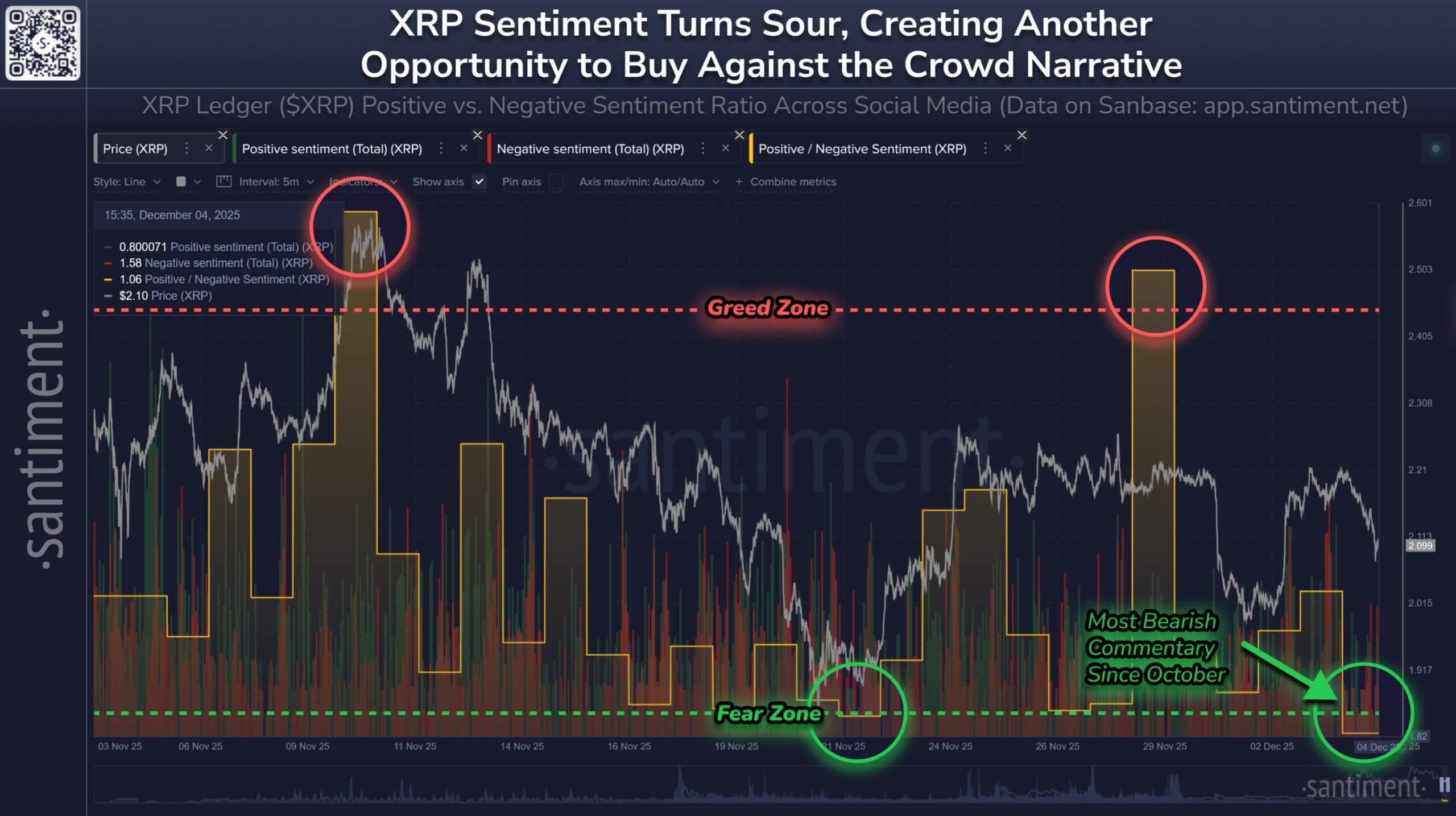

XRP is currently displaying a notable divergence between public perception and actual market behavior. Social sentiment data reveals increased bearish commentary, even as the XRP Ledger (XRPL) sees heightened activity and regulated XRP products attract steady inflows. This split suggests a potential disconnect between retail investor sentiment and the actions of larger, institutional players in the crypto space.

Data indicates that XRP has entered a “Fear” zone, with negative commentary outweighing bullish discussion. This shift comes after a price decline, pushing the token to a lower valuation before a slight recovery.

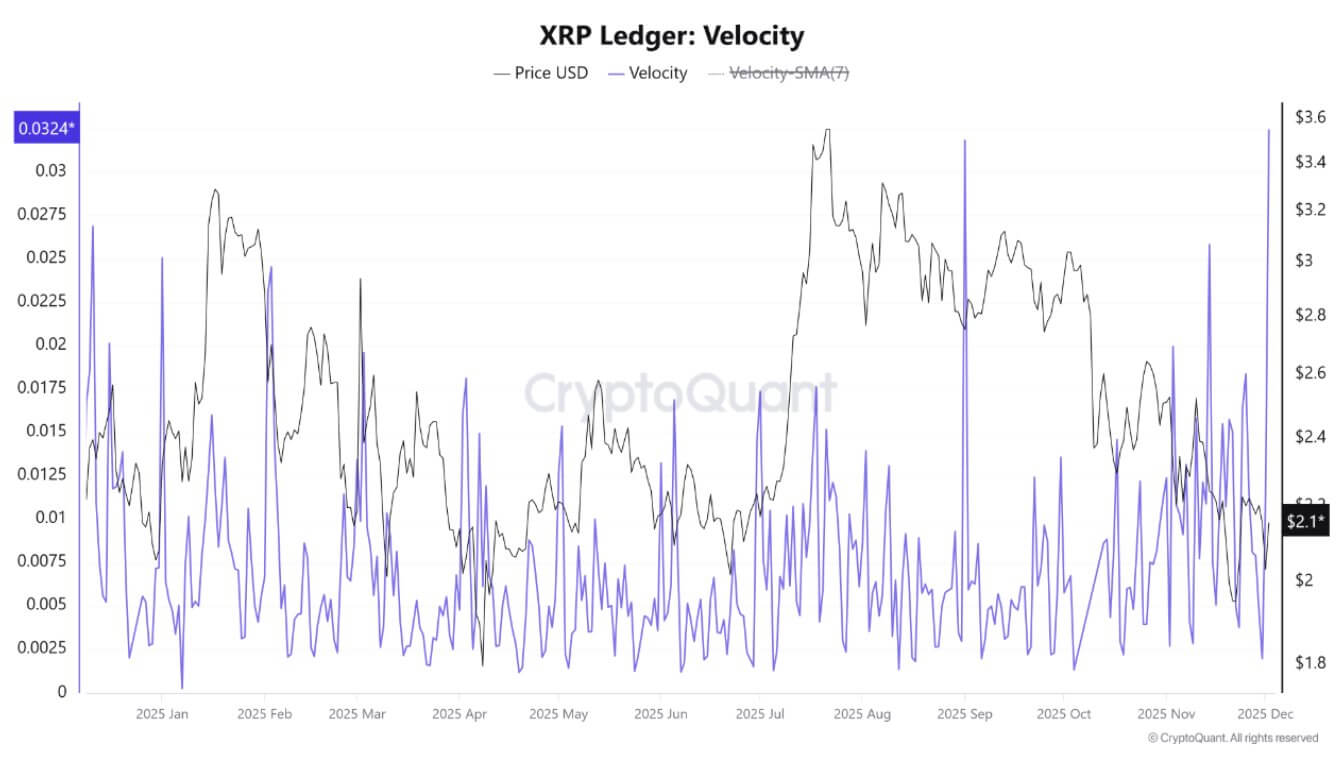

Simultaneously, the XRP Ledger (XRPL) is experiencing increased transactional intensity. On-chain data shows the network’s velocity metric reaching its highest level this year, suggesting active movement of XRP between addresses.

Interestingly, while retail sentiment turns negative, XRP exchange-traded products are drawing significant inflows. This suggests that institutional investors are maintaining or increasing their exposure to XRP through regulated channels, even as retail traders express concern.

This pattern aligns with a broader rotation toward mid-cap assets, and XRP ETFs have seen substantial inflows since launch, outperforming other crypto ETFs.

Ripple is strategically expanding its business model, investing significantly in acquisitions to position XRP as a key utility for corporate finance. These acquisitions aim to integrate digital asset rails into existing corporate cash management workflows, enhancing XRP’s role in global value transfer. By building a closed-loop liquidity environment, Ripple seeks to provide a comprehensive suite of services, including custody, execution, and financing for OTC trading.

The current situation presents a divergence between crowd emotion and market activity. While retail traders express fear based on recent price drops, institutional participants are treating the volatility as an opportunity to strengthen their positions. This disconnect suggests that the actions of larger players may ultimately influence XRP’s price trajectory.

Related: $2.3 Trillion Liquidity Shock: Franklin Templeton Says XRP Is Next in Line for Massive Inflows

Source: Original article

Quick Summary

XRP’s social sentiment is currently in a “Fear” zone, contrasting with increasing on-chain activity. Despite negative retail sentiment, XRP ETFs are experiencing inflows, indicating institutional interest. Ripple is strategically expanding its market footprint through acquisitions, aiming to enhance XRP’s utility.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.