XRP price is in an enviably bullish position after Thursday’s stomach-churning price action across the crypto complex. Despite a tick higher in core CPI inflation the market in risk assets initially fell sharply and then rallied.

XRP price is in an enviably bullish position after Thursday’s stomach-churning price action across the crypto complex.

Despite a tick higher in core CPI inflation the market in risk assets initially fell sharply and then rallied.

This defiance in the face of sticky inflation is highly significant, as it could mean that the head-fake bear rallies of recent times could have created the conditions for a definite breakout.

Ripple’s XRP cross-border liquidity token could be said to be the best positioned crypto to benefit from renewed bottom-dipping buying interest.

Although the price has run into resistance around the $0.50 level, market participants are increasingly optimistic that the signs coming out of the long-running court case point to the likelihood of a positive outcome.

And even if Ripple doesn’t win the case but ends up with a messy tie, a settlement that clears a way through the regulatory uncertainty holding back a re-rating of XRP would still be bullish.

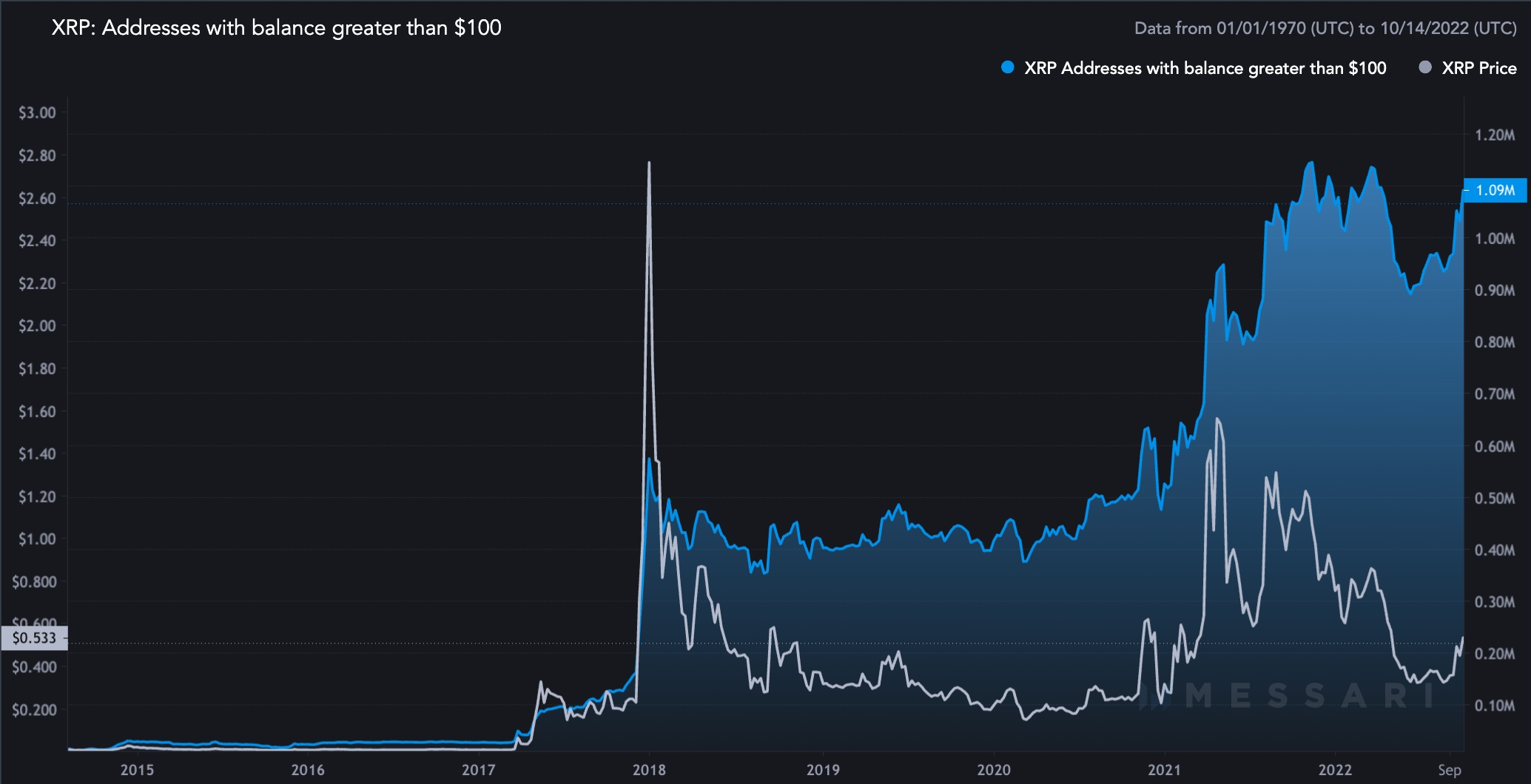

XRP addresses holding more than $100 worth of tokens nears all-time high

Indeed the bullishness around XRP right now can be gleaned from the behaviour of XRP holders.

If we overlay the XRP price with the supply of XRP tokens at addresses holding at least $100 in value, the number, 1.07 million, is near the all-time high last seen in November 2021 (1.14 million).

But the interest in XRP is not just speculative interest in the markets but is also seen in product adoption.

On 11 October Ripple announced that French payments firm Lemony was its latest on-demand liquidity customer. Lemony will be using RippleNet and the XRP token to enable crypto payments and to improve its treasury processes

What does this mean for the XRP price?

Looking at the market cap of the crypto asset since 2015 using 1 week candles and there may be some clues.

A descending triangle that began in 2015 culminates in apex completion where it meets the long-term trend line. It was this conjunction that was followed by parabolic move higher by XRP, which was not completed until the price printed its all-time high.

#XRP – Market cap chart. Either we break out of that yellow trendline.. or reject and possible capitulation wick before that parabolic move up! Either way, Im ready!

Hope yall took advantage of the orange box price I been posting for months! 200 Retweets for update! $XRP pic.twitter.com/E9LvPG1Z1u

— JD ?? (@jaydee_757) October 13, 2022

Although the middle triangle in the chart is not annoyed, the current descending triangle began in 2021 and could presage a similar move higher.

Admittedly that move may not come to pass until the new year, but if the price can breakout above $0.50 there’s a promising ladder higher.

The technical set-up looks highly positive. However, the trigger to send XRP higher is likely to emanate from the court case.

If the SEC’s officers really did discuss among themselves the possibility of Ethereum being a commodity and not a security, that would blow a whole in the SEC’s case against Ripple, and would have wider implications for crypto regulations.

XRP is one of the best buys in crypto today.

XRP is sustainable too – and so is IMPT

It is also a good sustainable pick because of its fast and efficient blockchain.

Having said that there might be better choices as far as building a ESG crypto portfolio goes such as IMPT.

IMPT is bringing carbon offsetting to the blockchain and in the process to shoppers around the world.

The coin is currently in presale and may be worth taking the time to do your due diligence on.

Source: cryptonews.com

Related: $2.3 Trillion Liquidity Shock: Franklin Templeton Says XRP Is Next in Line for Massive Inflows

Quick Summary

XRP price is in an enviably bullish position after Thursday’s stomach-churning price action across the crypto complex. Despite a tick higher in core CPI inflation the market in risk assets initially fell sharply and then rallied.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.